February 2025 Bank of America Global Fund Manager Survey

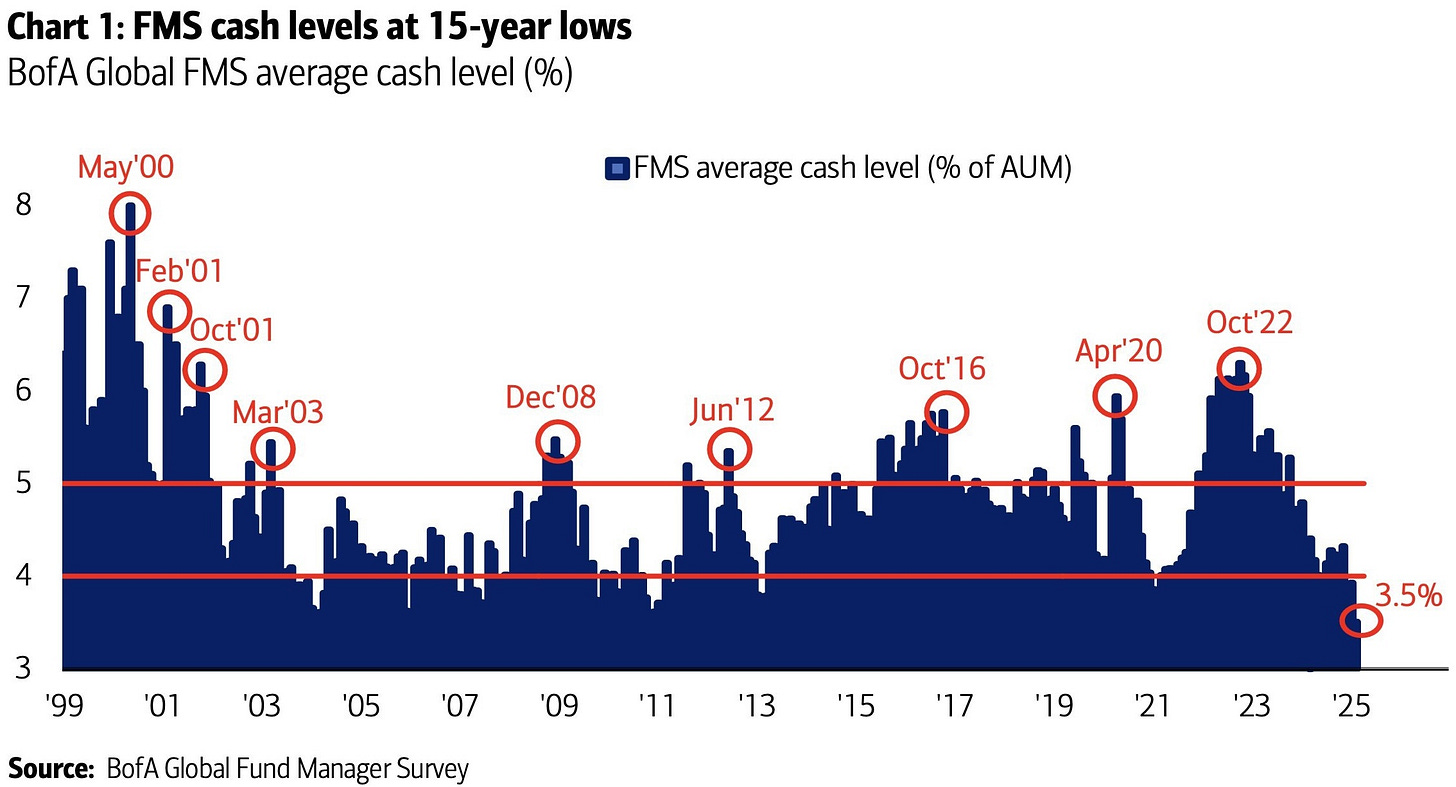

The February 2025 Bank of America Global Fund Manager Survey highlights a surge in investor bullishness, with cash levels dropping to 3.5%, the lowest since 2010. This reflects a significant increase in risk-taking behavior, supported by expectations of robust economic growth and lower interest rates.

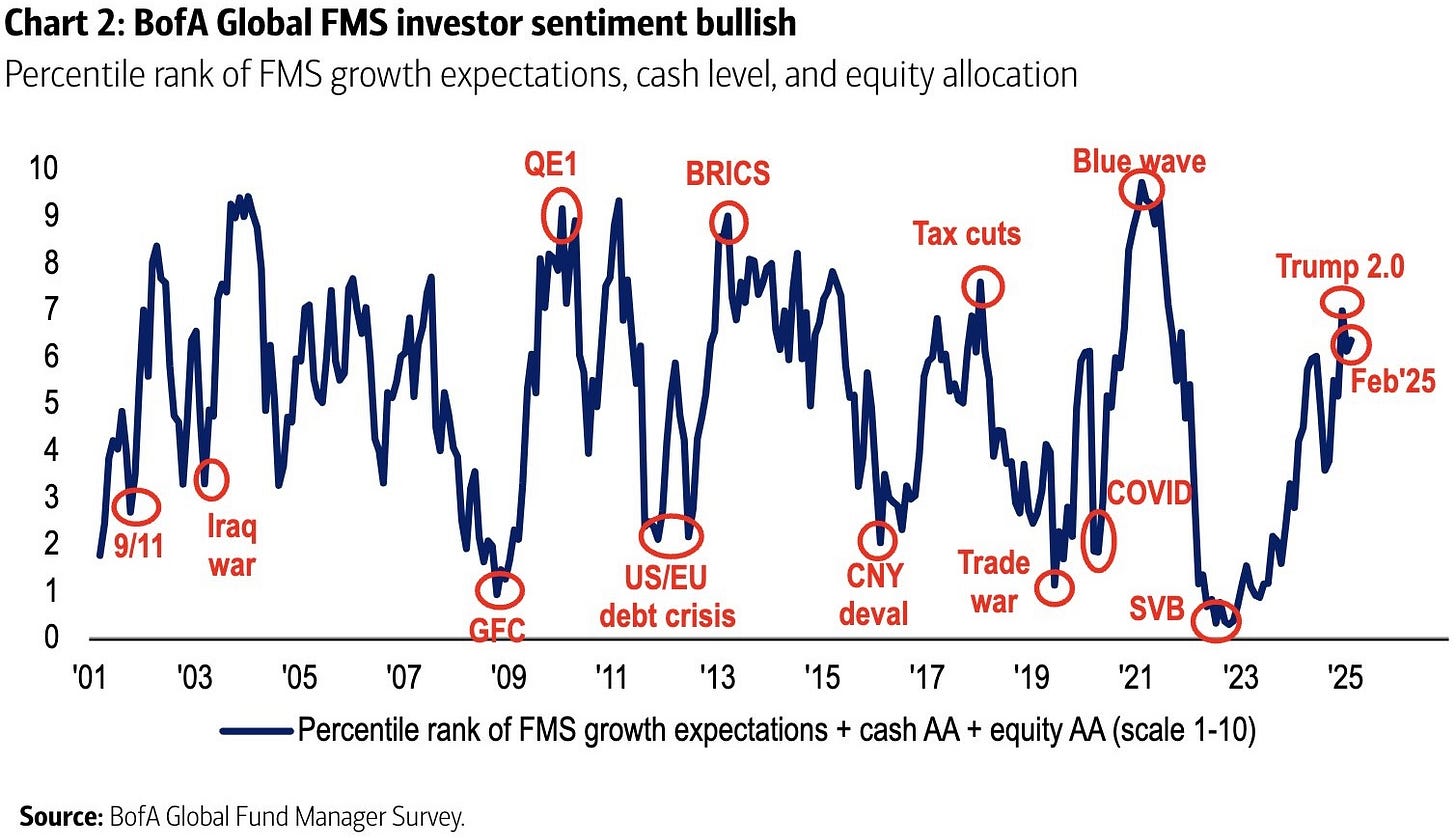

Investor sentiment, as measured by cash levels, equity allocation, and global growth expectations, rose to 6.4 from 6.1 but remains below December 2024’s peak.

Global recession fears have dropped to a three-year low, with 82% of investors believing a recession is unlikely, the highest confidence level since February 2022.

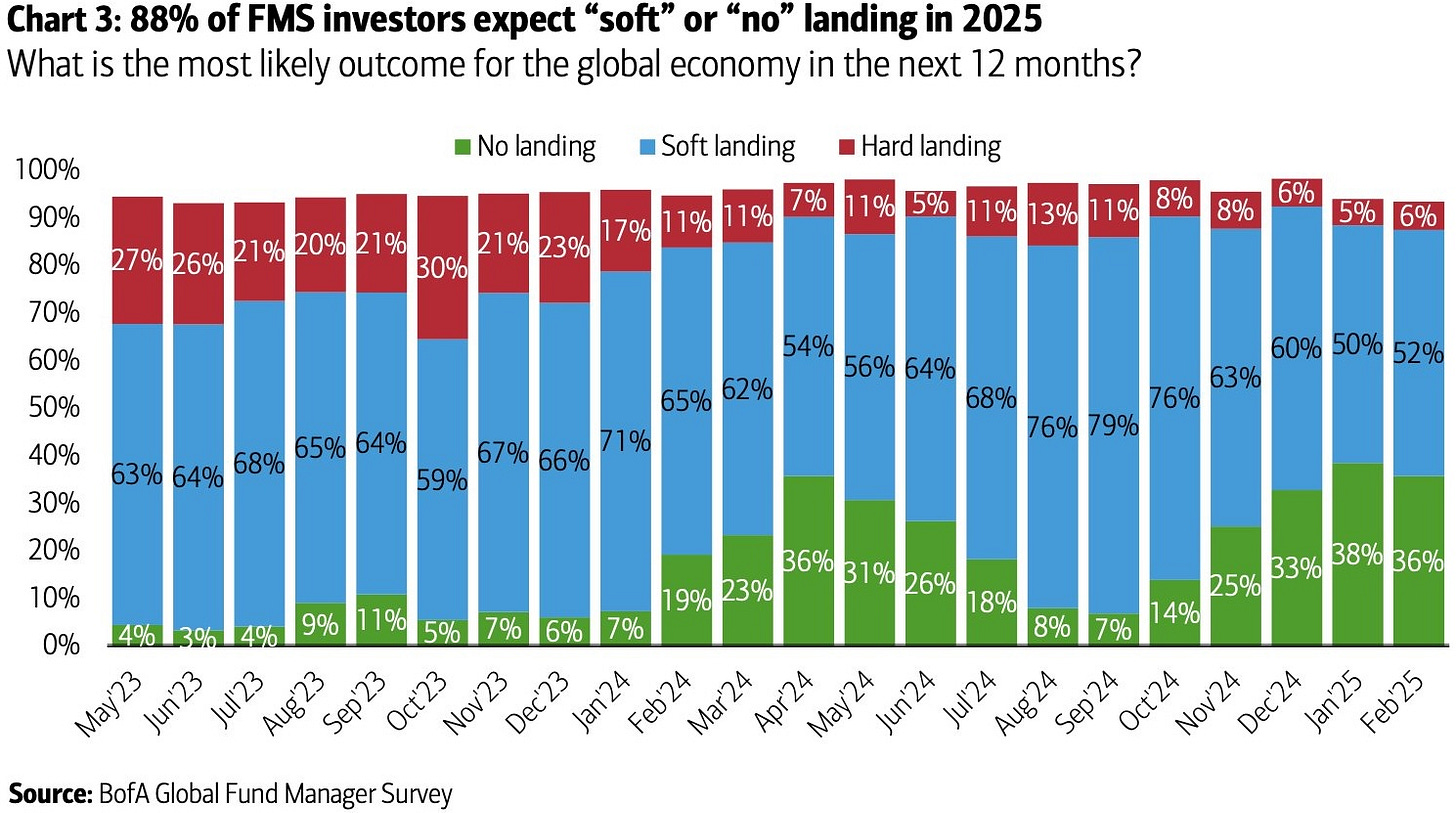

Economic landing expectations have also shifted, with 52% anticipating a "soft landing" (up from 50% in January), while "no landing" forecasts declined to 36% from a 21-month high of 38% in January.

Inflation expectations, however, have risen sharply to their highest level since October 2021. A net 4% of investors now expect CPI to rise over the next 12 months, a major shift from August 2024, when 76% expected inflation to decline.

Expectations for Federal Reserve rate cuts remain high, with 77% of fund managers predicting cuts in 2025. Within this group:

46% foresee two cuts (up from 39% in January).

27% expect one cut (unchanged).

4% anticipate three cuts (down sharply from 13%).

Only 1% expect the Fed to hike rates.

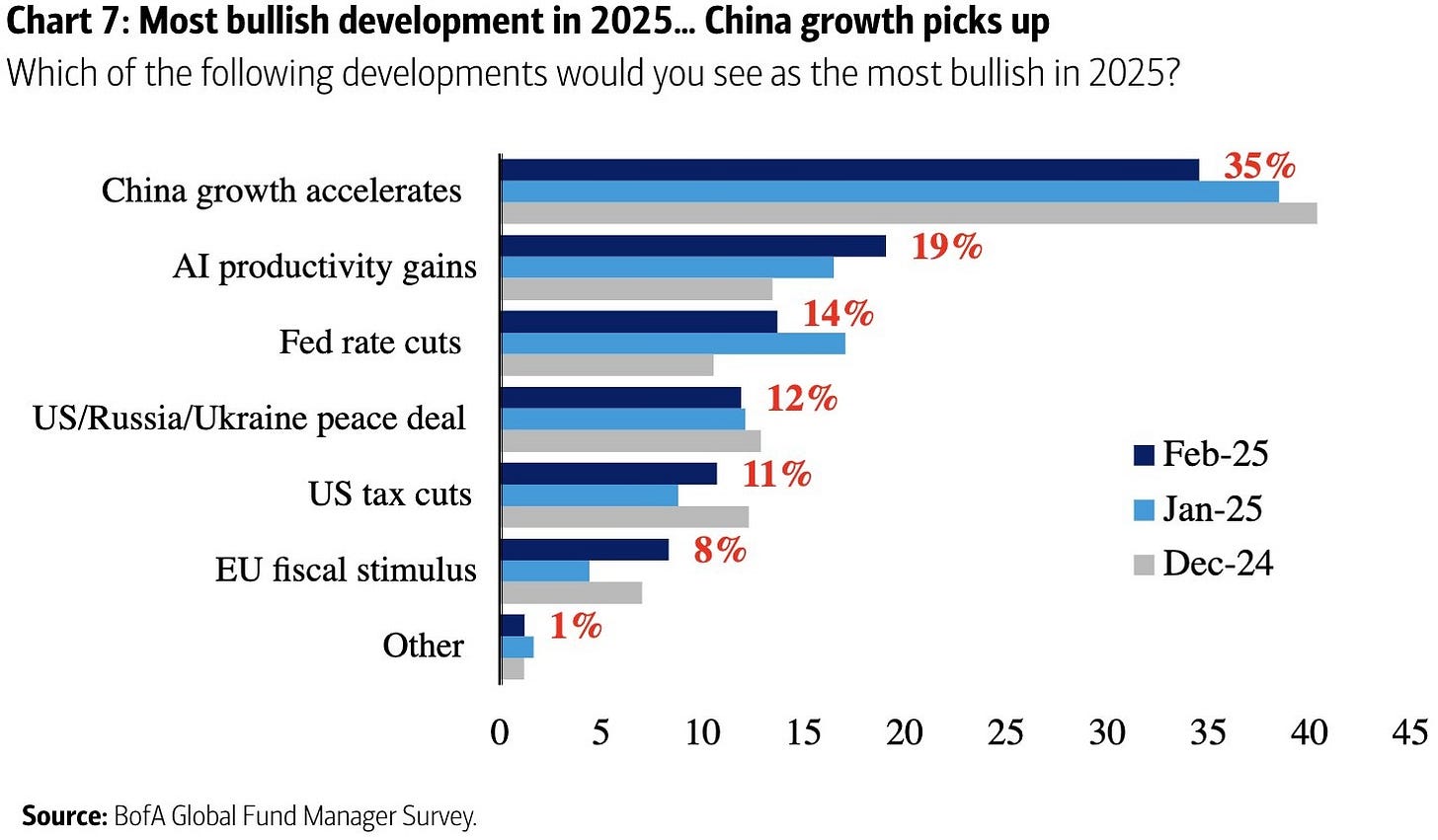

The biggest bullish driver for risk assets in 2025 is anticipated to be China’s economic growth acceleration, cited by 35% of investors, though this has slightly declined from 38% in January. AI productivity gains rank second (19%, up from 16%), followed by Fed rate cuts at 14%.

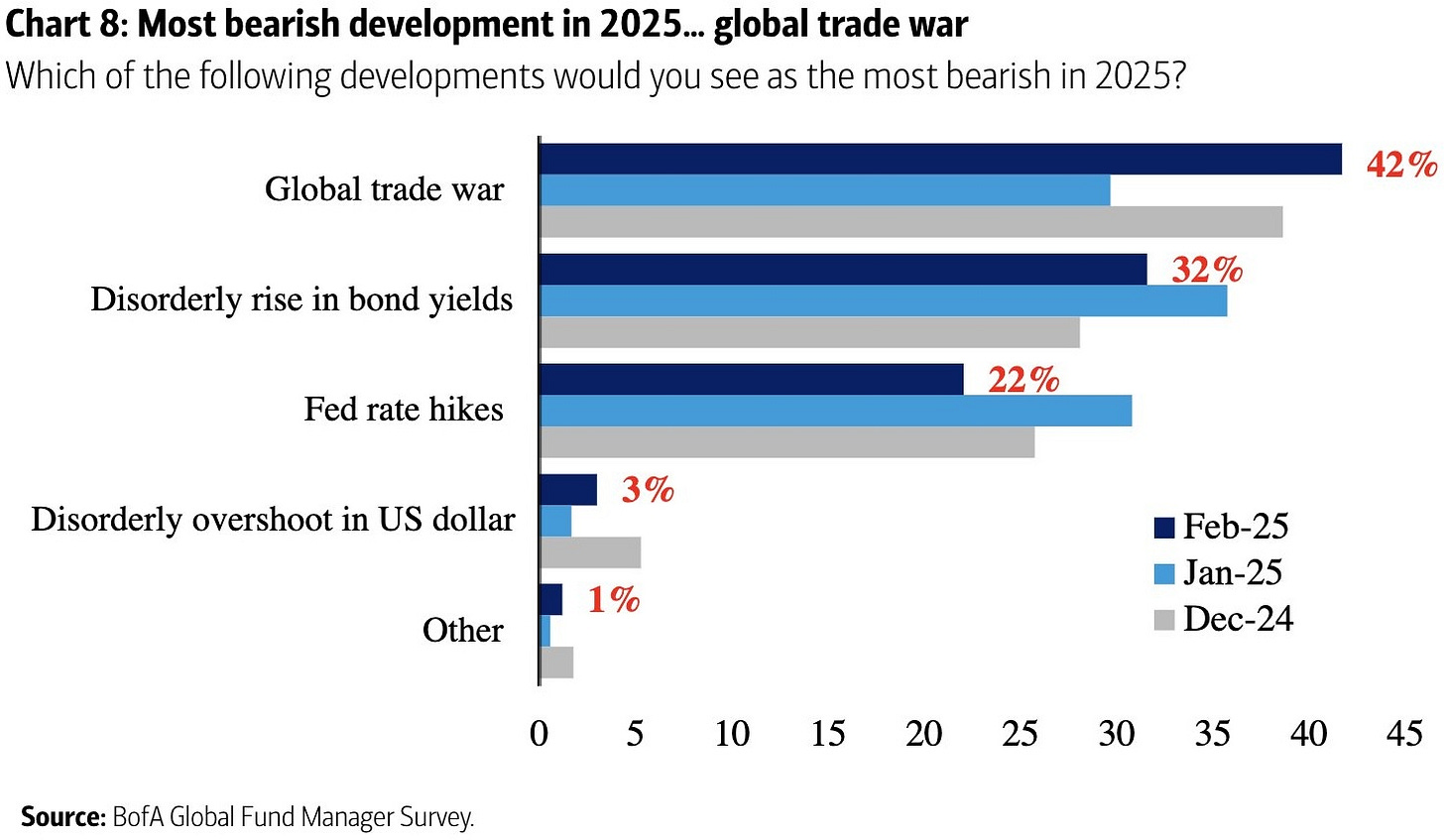

Conversely, the most bearish risks include a global trade war (42%), a disorderly rise in bond yields (32%), and potential Fed rate hikes (22%).

A recessionary trade war became the top "tail risk" for 39% of respondents, surpassing inflation-driven Fed hikes (31%). The AI bubble, ranked third, is now seen as a growing risk by 13% of investors.

In the event of a full-blown trade war, 58% of respondents expect gold to be the best-performing asset, far ahead of the U.S. dollar (15%) and Treasuries (9%).

The "long Magnificent 7" remains the most crowded trade, increasing to 56% in February, followed by "long U.S. dollar" (17%) and "long crypto" (13%).

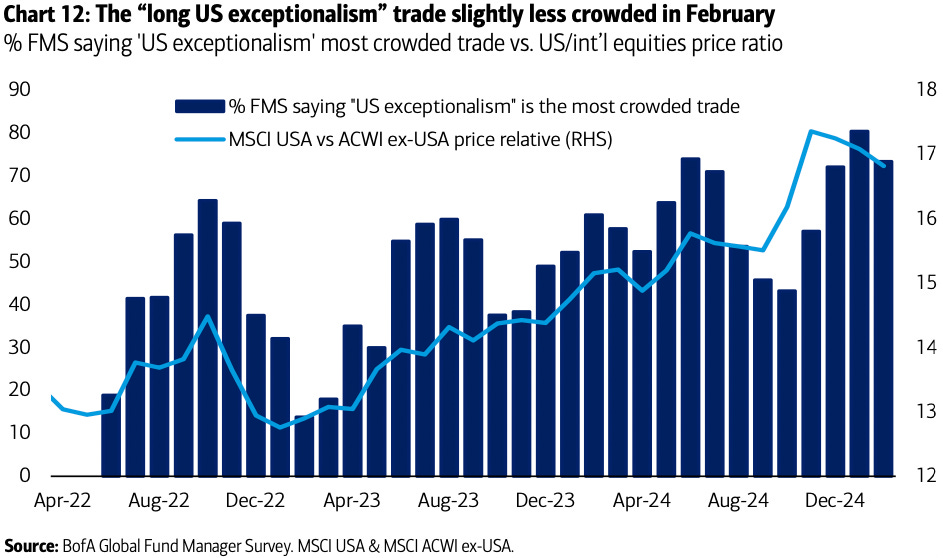

However, the dominance of U.S. exceptionalism appears to be weakening, as the proportion of investors viewing "long U.S. exceptionalism" as the most crowded trade dropped from 80% in January to 73%.

Additionally, 89% of fund managers now see U.S. equities as overvalued, the highest level since at least 2001.

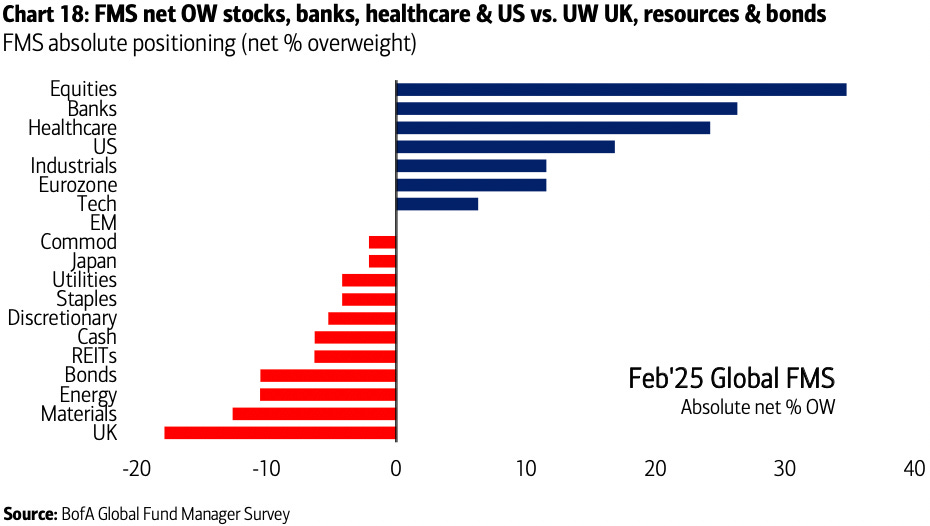

Investors continue shifting from U.S. stocks into European equities, commodities, and defensive sectors like healthcare and staples. Tech saw the sharpest decline in allocation, marking its largest month-on-month drop since September 2022.

Absolute positioning shows that equities, banks, and healthcare remain the most overweight, while UK stocks, materials, energy, and bonds are the most underweight. The Eurozone has seen a major inflow, with allocations rising to a net 12% overweight from just 1% in January and a stark reversal from the net 25% underweight in December. Conversely, U.S. equity exposure fell to a net 17% overweight, down from 19% in January and significantly below December’s 36% peak.

Relative to historical trends, investors are overweight utilities, banks, bonds, and U.S. equities while being significantly underweight cash, energy, tech, and emerging markets.

Global equities have overtaken U.S. equities as the most favored asset class for 2025, with 34% of respondents expecting them to be the best-performing asset, up from 21% in January. Gold follows at 22%, while U.S. equities are now third at 18%.

Within equity markets, the Euro Stoxx index is expected to be the top performer (22%), surpassing Nasdaq (18%) and Hang Seng (18%).

The U.S. dollar remains the most favored currency (31%), but gold saw a notable jump of 6 percentage points, now at 25%, ranking third behind the Japanese yen (30%).

You can find more articles in our Telegram channel at https://lnkd.in/euxNeUuZ