May 2025 Bank of America Global Fund Manager Survey

The latest Bank of America Global Fund Manager Survey shows a marked improvement in investor sentiment, driven primarily by easing tensions in the U.S.-China trade conflict. Despite this improvement, positioning among investors continues to reflect an overall cautious stance.

A key indicator of lingering caution is investor expectations regarding U.S. tariffs on Chinese exports. Fund managers currently anticipate tariffs to stabilize at around 37%, notably above the Trump administration’s newly announced tariff rate of 30%, significantly reduced from the prior 145%. This divergence between investor expectations and the official tariff policy underscores persistent uncertainty about trade negotiations and their potential impact on the global economy.

Investor pessimism has notably decreased, with a net 59% now expecting a weaker global economy over the next 12 months, significantly lower than the record-high 82% reported in April.

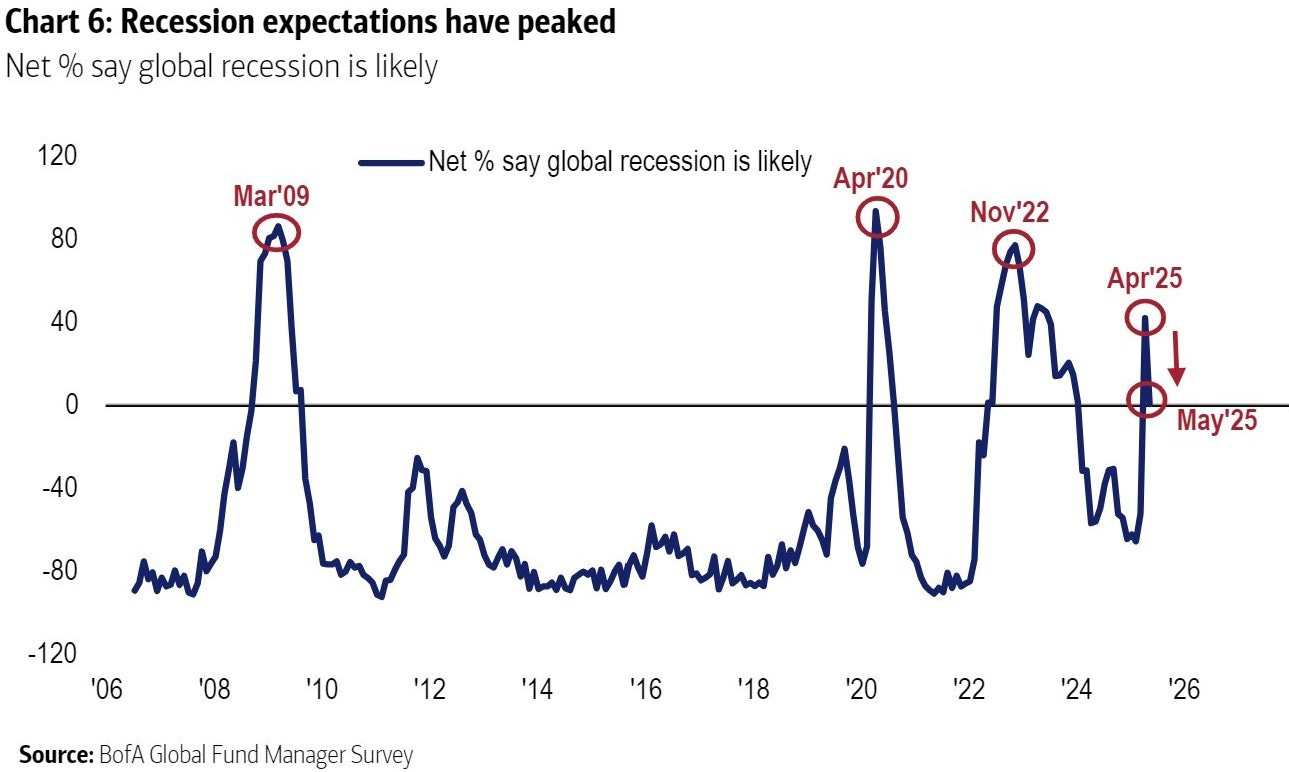

Most strikingly, the percentage of managers anticipating a global recession plunged to just 1%, down dramatically from 42% last month, underscoring greatly reduced fears of a severe downturn.

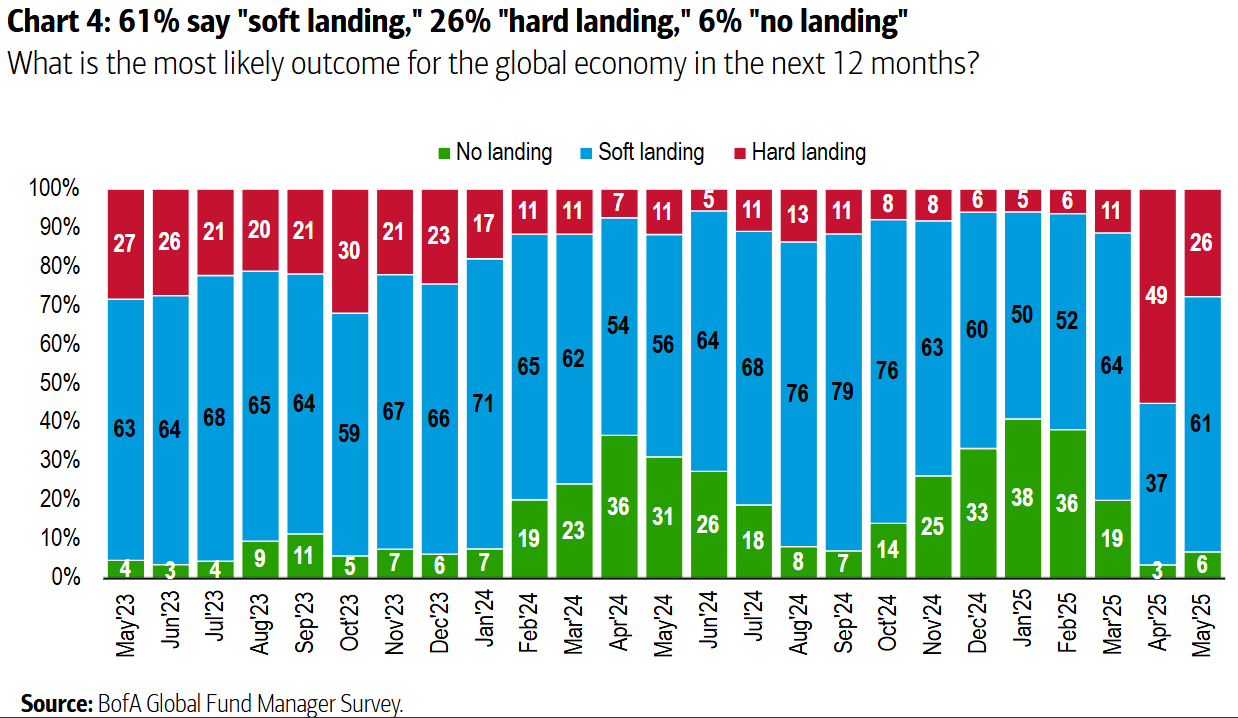

The prevailing expectation among investors has shifted decisively toward a “soft landing” scenario, now anticipated by 61% of managers, up sharply from 37% previously. This indicates increased confidence that the global economy will experience a manageable slowdown rather than a deep recession.

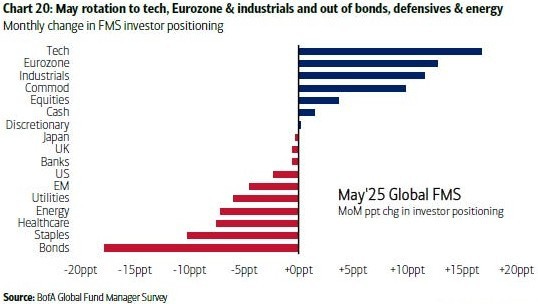

Cash balances held by fund managers declined slightly, to 4.5% from 4.8% in April, suggesting emerging optimism, though levels remain elevated compared to historical averages. Asset allocations also underwent significant adjustments, with investors notably reducing exposure to defensive sectors such as bonds, consumer staples, healthcare, and utilities, and rotating instead into technology, Eurozone equities, and industrials. In fact, tech stocks recorded their largest monthly inflow since March 2013, highlighting increased confidence in cyclical sectors as trade tensions ease.

Regional preferences revealed a pronounced shift as well. Investors lowered their exposure to U.S. equities to a net 38% underweight, the lowest allocation to the region since May 2023.

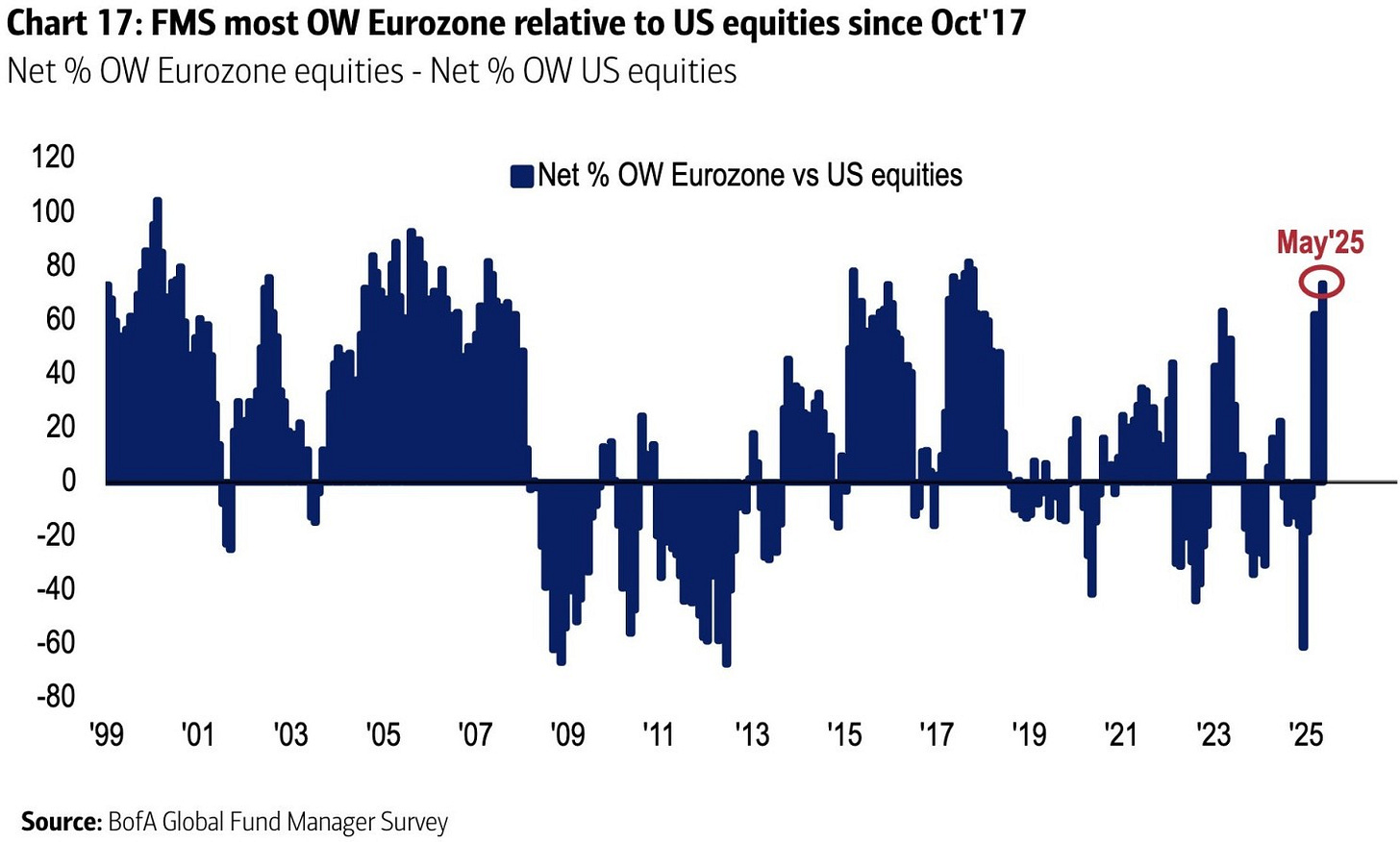

Conversely, Eurozone equities saw a significant increase in allocations, achieving their highest overweight position relative to U.S. stocks since October 2017. This suggests a strategic preference for European markets, reflecting more favorable valuations, growth prospects, and potentially lower geopolitical risks.

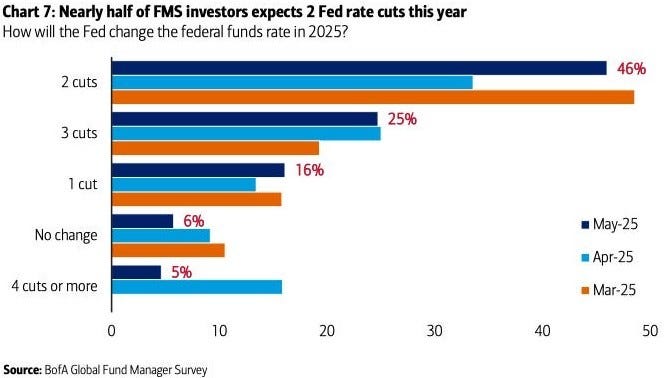

The survey also noted an increasingly dovish outlook on U.S. monetary policy. Forty-six percent of respondents now expect two Federal Reserve rate cuts by the end of 2025, up notably from 34% in April, indicating growing expectations for monetary easing.

At the same time, skepticism about U.S. fiscal policy remains elevated, with 75% of investors expecting recent U.S. tax cuts to widen the budget deficit.

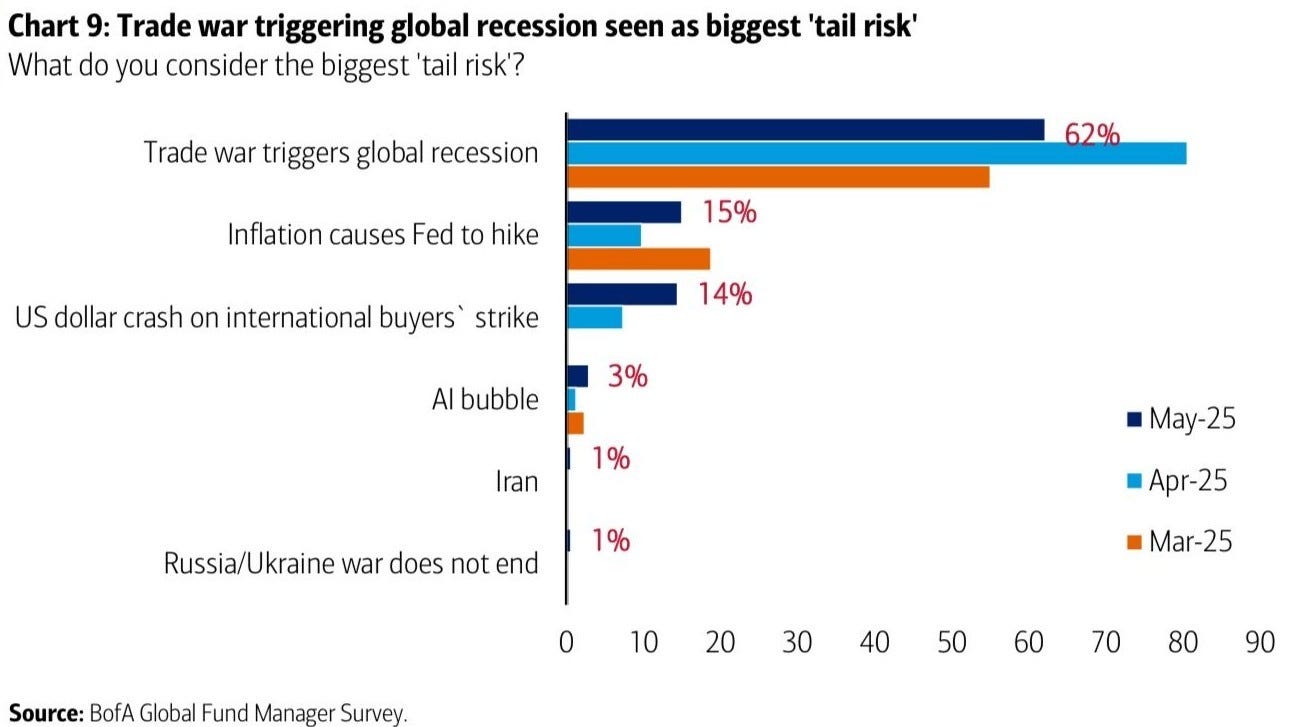

Despite the improved market sentiment, the main tail risk cited by respondents remains the potential for a "trade war triggering a global recession," though concerns have moderated somewhat. This risk was identified by 62% of investors, down from a peak of 80% in April, suggesting that while fears have lessened, uncertainty remains significant

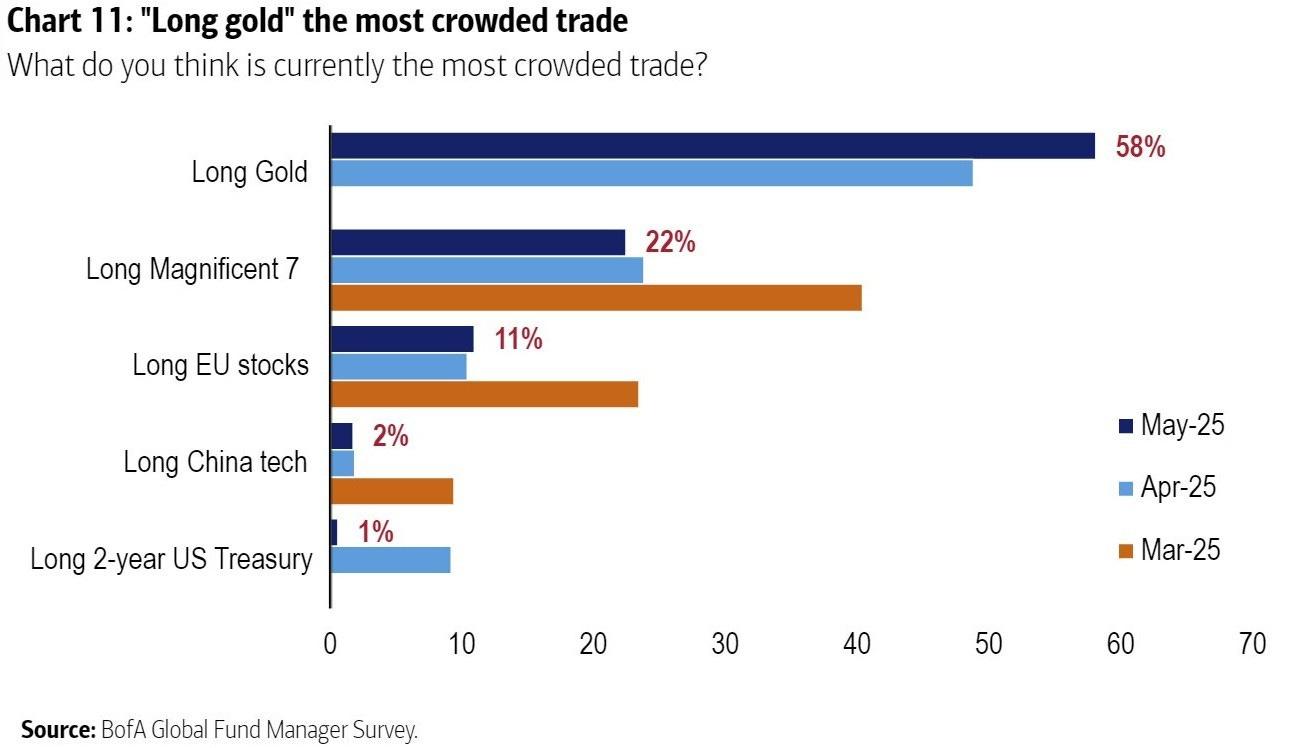

In terms of crowded trades, the "Long Gold" position strengthened its dominance as the most popular choice, rising to 58% of investors from 49% in April. In contrast, the previously favored "Long Magnificent Seven" trade was held by just 22% of respondents. Interestingly, despite the growing allocation toward European equities, only 11% of investors identified this as a crowded trade, marginally higher than the 10% in the prior month.

This continued preference for gold highlights ongoing caution and defensive positioning, despite a record number of investors identifying gold as significantly overvalued—the highest reading in the survey's 17-year history.

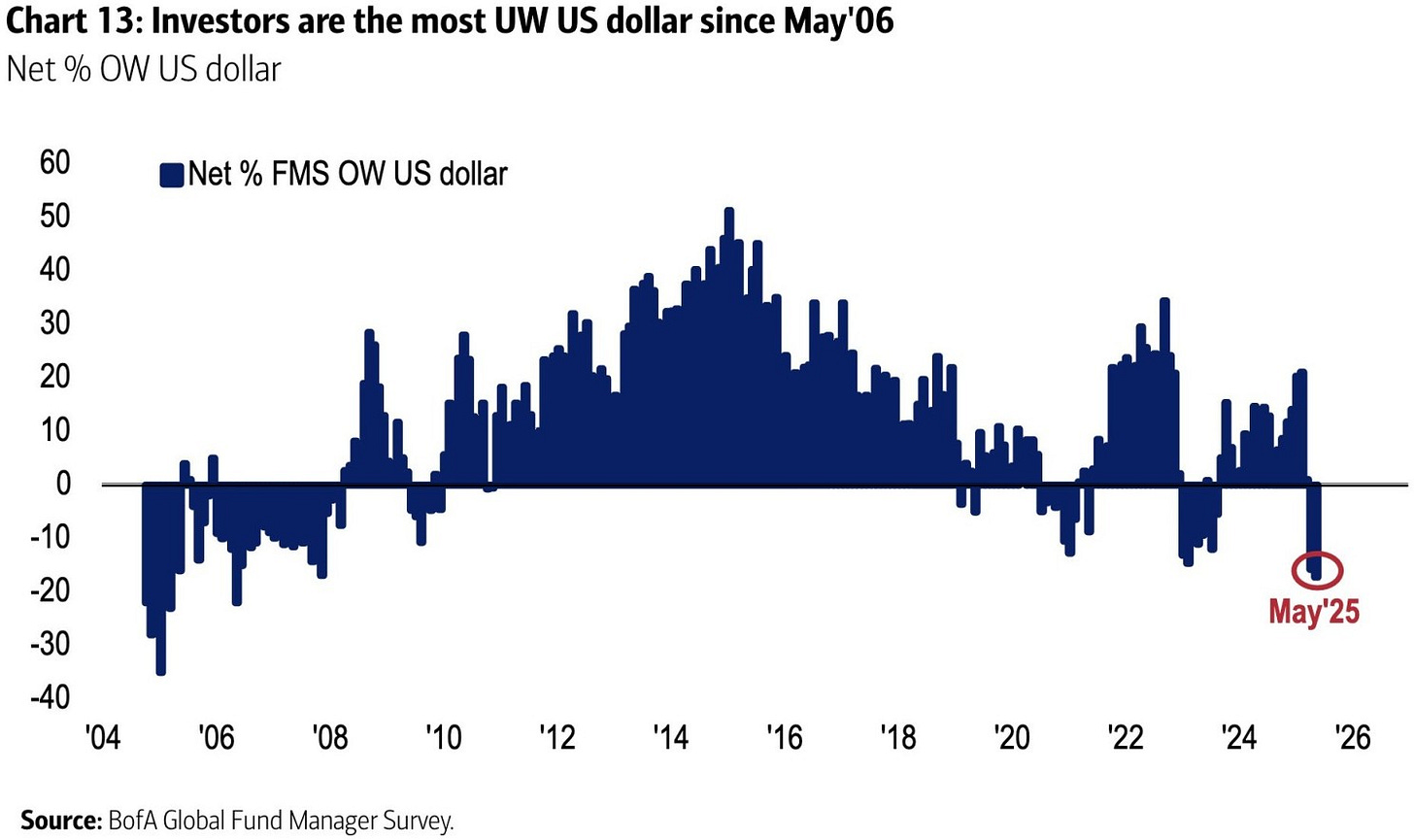

Lastly, investors expressed strong bearish sentiment toward the U.S. dollar, now positioned at the most underweight relative to historical norms since May 2006, aligning with market expectations of Fed rate cuts and anticipated shifts in global capital flows away from U.S. assets.

You can find more articles in our Telegram channel at https://t.me/atranicapital_eng