Week #23 — Market Update for June 2-6, 2025

Executive Summary

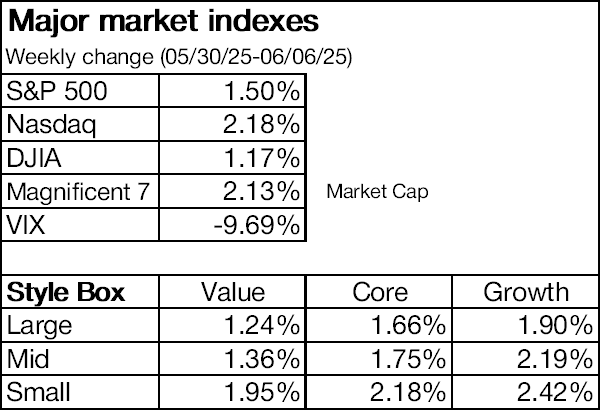

The U.S. stock market rose for a second consecutive week, with major indices gaining between 1.2% and 2.2%. Investor optimism was bolstered by stronger-than-expected jobs data, easing concerns about an immediate economic slowdown from tariffs, and by the anticipated resumption of U.S.-China trade negotiations on Monday. The S&P 500 notably closed above the 6,000 milestone for the first time since February, now just 2.3% below its all-time high, and over 20% above its April 8 low.

Tesla attracted significant attention, plunging 14.8% due to a public conflict between CEO Elon Musk and President Donald Trump. Trump harshly criticized Musk’s opposition to the recent tax bill, threatening to terminate federal contracts and subsidies—including around $22.5 billion awarded to Tesla and SpaceX since 2000. Notably, the selloff remained confined to Tesla shares, with no broader market spillover.

Crypto markets continued their disconnected dynamics relative to equities. Bitcoin gained just 0.3% week-over-week, while major tokens declined between 2% and 8%. This coincided with a second consecutive week of net outflows from spot Bitcoin ETFs, totaling $132 million, according to Farside data.

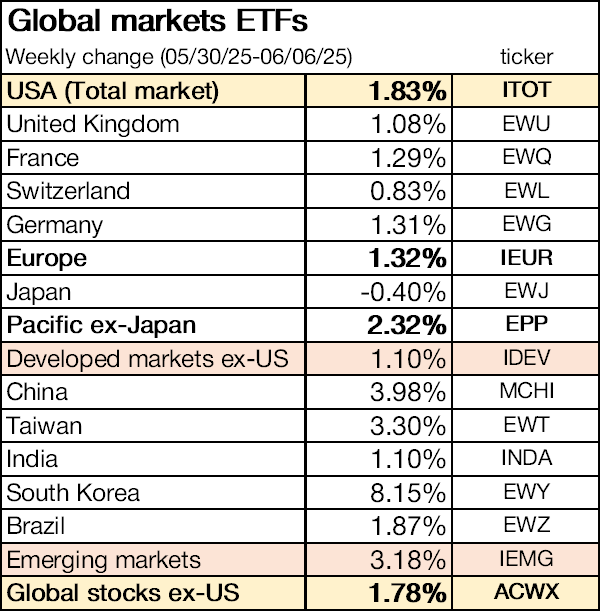

Globally, country ETFs moved in line with the U.S., pushing the global ex-U.S. equity index up 1.8%.

Global business activity modestly improved in May, with the J.P. Morgan Global Composite PMI rising to 51.2 from April’s 17-month low, primarily driven by stronger growth in services, particularly business services. However, manufacturing slipped back into contraction at 49.1, reflecting weak global demand and continued disruption from U.S. tariff policies. Intermediate and investment goods production notably declined. Regionally, India significantly outperformed, maintaining robust growth, whereas the U.S. saw improved services but persistent manufacturing weakness. The eurozone experienced marginal expansion despite contractions in Germany and France, and Canada faced a sharp downturn due to tariff-induced disruptions. Emerging markets, including China, Brazil, and Japan, experienced substantial manufacturing weakness, contributing to a second consecutive monthly decline in global trade.

Market expectations for a Fed rate cut in June rose slightly to 2.6% from 2.2%. Investors continue pricing two rate cuts for 2025—in September and December—totaling 39 basis points, down from 48 basis points previously.

Consistent with this outlook, the U.S. Treasury curve shifted upward by about 7 basis points on average. The 10-year Treasury yield rose by 11 basis points to 4.51%, while the 30-year yield increased by 4 basis points to 4.97%, according to Bloomberg.

For comprehensive insights and deeper context, please refer to the full article.

US Stock Market

The U.S. stock market rose for the second consecutive week, with major indices increasing between 1.2% and 2.2%, as investor optimism was buoyed by stronger-than-expected jobs data that eased fears of an immediate economic slowdown caused by tariffs, and by the planned resumption of U.S.-China trade negotiations on Monday. Meanwhile, the S&P 500 closed above the 6,000 milestone for the first time since February, remaining just 2.3% below its all-time high, and has surged more than 20% from its April 8 low.

Over the week, Tesla showed interesting dynamics, with shares plummeting by 14.8% following a public conflict between the company’s CEO, Elon Musk, and President Donald Trump. Trump harshly criticized Musk’s opposition to the recent tax bill, threatening to terminate crucial federal contracts and subsidies that have benefited Musk’s companies—including around $22.5 billion awarded to Tesla and SpaceX since 2000. Notably, the selloff was concentrated in TSLA, and there were no spillover effects into the broader market.

In terms of sector performance, eight out of eleven sectors showed positive momentum.

The Fear & Greed Index, which gauges market sentiment, increased slightly to 63 from 62 a week ago.

The SPY ETF has regained bullish traction, successfully approaching the key psychological level of 600 again. The RSI has risen from 60.69 to 65.04, signaling strengthening bullish momentum while approaching—but still below—overbought territory, highlighting potential near-term caution. Price action continues to hold well above the confluence of key support from the upward-sloping 100-day and 200-day SMAs near the 580 area, reinforcing the overall bullish technical framework.

Cryptocurrency Market

The crypto market continues to exhibit a disconnected dynamic relative to stock markets, with Bitcoin increasing by just 0.3% Friday-over-Friday, while most major tokens declined from 2% to 8%. This coincides with the second consecutive week of net outflows from spot Bitcoin ETFs, which according to Farside data reached $132 million.

Global Markets

Globally, country ETFs moved in tandem with the U.S. market, with the global ex-U.S. equity index rising by 1.8%.

The ACWX ETF has resumed its upward momentum, now closely approaching the upper boundary of its ascending channel, suggesting continued bullish strength. The RSI has rebounded from 63.69 to 69.40, again reaching the edge of overbought territory, which reinforces the robust bullish sentiment but simultaneously signals heightened potential for near-term consolidation or a corrective pullback. The price remains well-supported by rising key SMAs—the 50-day, 100-day, and 200-day—highlighting the overall bullish trend.

Economic Indicators, Statistics and News

Several important macroeconomic indicators and economic news were published during the week:

Global

· The OECD sharply downgraded its global economic outlook in response to escalating trade tensions and protectionist policies spearheaded by the US under President Trump. The organization now projects global GDP growth to slow to 2.9% in 2025, down from 3.3% in 2024, with the US expected to see its growth rate drop to 1.6% from 2.8%, reflecting the most severe downward revision among major economies. The primary drivers of this slowdown are widespread tariff increases, notably Trump’s recent move to double steel and aluminum tariffs to 50%, alongside heightened policy uncertainty and retaliatory actions by major trading partners.

The OECD warns that the ripple effects of these trade barriers are eroding business and consumer confidence, stifling investment, pressuring job growth, and fueling inflationary risks globally. For the US specifically, additional headwinds include reduced export growth, a notable decline in net immigration, and growing fiscal strains, as weaker economic activity more than offsets tariff revenue and spending cuts, leading to an expanding budget deficit. The organization anticipates US inflation will remain elevated, likely delaying Federal Reserve rate cuts until 2026, and cautions that inflation expectations could become unanchored, further complicating monetary policy.

The ongoing trade conflict is reverberating through key bilateral relationships. The US raised tariffs on steel and aluminum imports from most countries, with rates now at 50%, though the UK received a temporary exemption as it seeks a final trade agreement before a July 9 deadline. The EU expressed strong regret over the US move, emphasizing that such actions undermine ongoing trade negotiations, and is preparing countermeasures targeting a broad swath of US goods should talks fail. Currently, Trump’s tariffs impact about 70% of EU exports to the US, covering €380 billion worth of goods, and the bloc is readying further retaliatory tariffs if necessary.

Japan is pressing to conclude trade negotiations swiftly, potentially even ahead of the upcoming G7 Summit in Canada next week, according to Japan’s top negotiator Ryosei Akazawa. He emphasized urgency due to daily economic damage caused by heightened US tariffs, including the recent doubling of steel and aluminum duties to 50% and a looming increase of other goods' tariffs from 10% to 24% in early July if no deal is reached. Prime Minister Shigeru Ishiba approved emergency funds to mitigate tariff impacts, as Japan faces a growing risk of technical recession and heightened political stakes ahead of July’s upper house elections.

Meanwhile, the US and China scheduled trade discussions to resume June 9 in London, following President Trump’s recent 90-minute call with Chinese President Xi Jinping, where Xi reportedly agreed to restart rare-earth exports critical to US industries, including electric vehicles and defense systems. While Trump expressed optimism, Wall Street remains cautiously hopeful due to unresolved issues, including US restrictions on Chinese technology companies like Huawei and the broader dispute over technology transfers. US Commerce Secretary Howard Lutnick's involvement may indicate potential openness to revising technology curbs.

· Global business activity improved modestly in May, as reflected by the J.P. Morgan Global Composite PMI rising to 51.2 from April’s 17-month low of 50.8. While this indicates expansion for the twenty-eighth consecutive month, the pace remained weak by historical standards, corresponding approximately to an annualized GDP growth rate of 2.0%, below the pre-pandemic average of 3.1%. This subdued expansion primarily reflects ongoing concerns related to U.S. tariff policies, though reports of uncertainty declined significantly compared to April’s near-record highs.

The service sector was a key driver behind May’s improved performance, with its PMI rising to 52.0, supported by business services in particular. In contrast, the manufacturing sector fell back into contraction at 49.1—the lowest reading in five months—due to deteriorating global demand conditions. Intermediate and investment goods sectors saw production declines, whereas consumer goods manufacturers continued expanding.

Geographical variations were pronounced. Among major economies, India led growth by a significant margin, maintaining robust performance in both manufacturing and services. Developed markets saw marginal improvement from April’s stagnation, led primarily by the United States, which experienced solid service-sector gains despite a third consecutive monthly manufacturing contraction. The eurozone reported only marginal overall expansion, with growth in Italy and Spain offset by contractions in Germany and France. Meanwhile, Canada saw the sharpest overall downturn among developed economies, marking six consecutive months of declining output due to disruptions from U.S. tariffs and broader policy uncertainty.

Emerging markets collectively experienced the weakest growth since December 2022, notably driven by a renewed manufacturing decline. Mainland China faced particular headwinds, with factory output contracting at the steepest rate since November 2022. Output also decreased notably in Brazil, Mexico, Indonesia, South Korea, Taiwan, Malaysia, and Japan, reflecting widespread manufacturing weakness exacerbated by tariff disruptions. Conversely, Russia saw modest improvement, lifting output for the first time in three months.

The global manufacturing downturn was accompanied by declining international trade, as new export orders fell for a second consecutive month, affecting both manufacturing and service providers. Only India and Australia reported export increases. Employment levels showed modest improvement globally, driven by services-sector hiring in the U.S., Japan, India, and Brazil, though manufacturing continued to shed jobs for the tenth straight month.

Inventories surged dramatically in the U.S., reaching the highest recorded levels in 18 years, driven by companies stockpiling goods amid tariff-induced supply chain fears. This buildup heightens near-term risks for subsequent production adjustments and further volatility. Additionally, U.S. manufacturers faced significant supply chain disruptions, second only to the UK globally, contributing to the steepest price increases among surveyed economies. Meanwhile, average selling prices fell in Asia and the eurozone, indicating a sharp divergence between regions regarding inflationary pressures.

Business optimism globally rebounded notably from April’s low point, lifting the Future Output Index by 3.3 points to 60.7. Despite this improvement, confidence remained below the historical average, especially reflecting persistent worries about U.S. tariff implications. Manufacturers worldwide reported reduced but still elevated uncertainty—running over five times its historical average—though signs indicate that sentiment may have bottomed in April.

US

· In May, U.S. economic activity presented a mixed but generally subdued picture, heavily influenced by ongoing tariff uncertainty and trade policy volatility. Manufacturing sector performance diverged between two key surveys. S&P Global's Manufacturing PMI indicated growth, rising to 52.0 from 50.2, driven by an unprecedented surge in input inventories as companies sought to front-run anticipated tariff-related supply disruptions and price hikes. In contrast, the Institute for Supply Management's (ISM) manufacturing index recorded a third consecutive month of contraction, falling slightly to 48.5 from 48.7, with imports plunging to a 16-year low at 39.9, highlighting significant trade-related strain.

The divergence between the two manufacturing reports stems largely from temporary inventory accumulation by firms anticipating further tariff-induced disruptions. Despite the short-term improvement noted by S&P Global, manufacturing production volumes contracted marginally for the third straight month, revealing underlying weaknesses. Tariffs significantly inflated input costs, leading to the steepest rise in factory gate prices since November 2022. Supplier delivery times lengthened sharply, with disruptions reaching levels unseen since October 2022, exacerbating cost pressures across industries.

ISM industry-specific feedback emphasized extensive tariff-related disruptions. Transportation equipment, electronics, chemical products, machinery, and primary metals industries all reported elevated uncertainty and operational challenges directly attributed to tariffs. As a result, manufacturers expressed cautious optimism, forecasting improved conditions contingent upon greater clarity around U.S. trade policy.

The services sector, similarly affected by tariffs and policy uncertainty, demonstrated contrasting signals. S&P Global's Services PMI improved notably to 53.7 in May, rebounding from April’s 50.8, driven by stronger domestic demand and a stabilization of the trading environment following tariff pauses. This resulted in enhanced business confidence and modest employment growth, although employment gains were insufficient to prevent a significant backlog accumulation. Input costs surged at their highest rate since June 2023, prompting service providers to raise prices at the sharpest pace since August 2022, thus adding upward pressure to inflation.

However, ISM's Services PMI contradicted these positive developments, slipping into contraction at 49.9—the first decline in nearly a year. New orders notably deteriorated to 46.4, and business activity stagnated, indicating broader economic uncertainty among businesses. ISM respondents underscored escalating costs due to tariffs, diminished purchasing confidence, and delayed investment and hiring decisions.

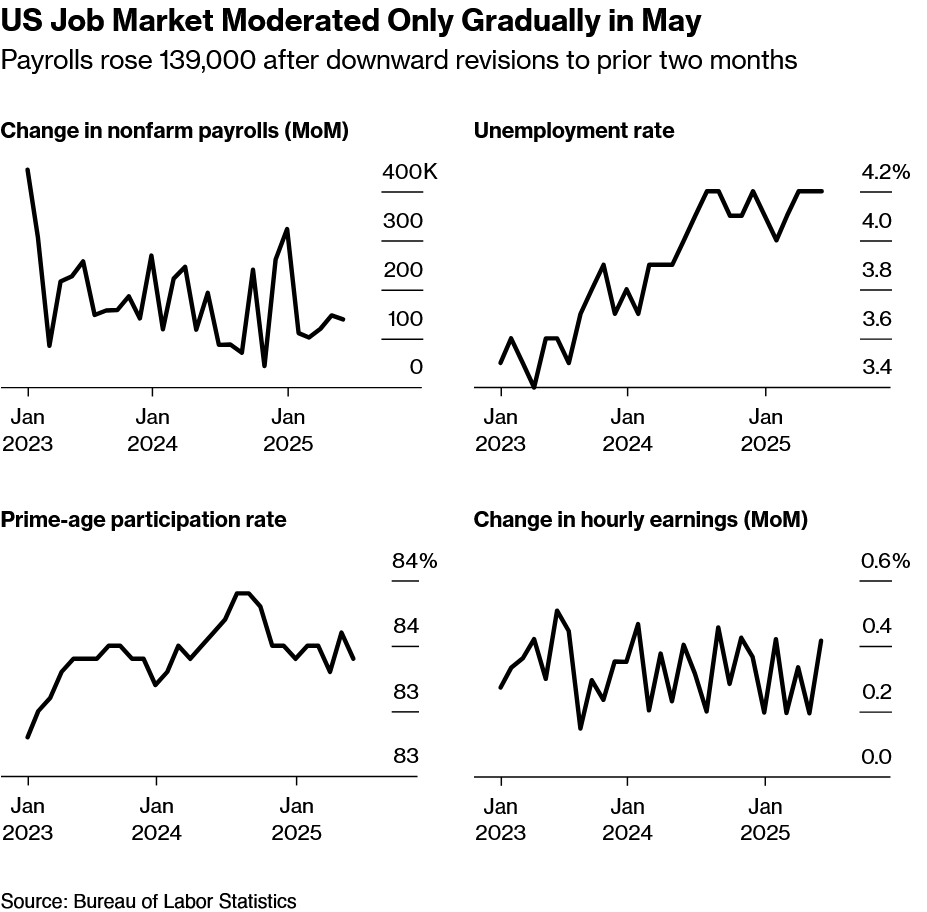

· US labor market data for May signal a gradual cooling, as job openings unexpectedly rose to 7.39 million in April, but underlying details show softer labor demand in key discretionary sectors and manufacturing. The number of job vacancies per unemployed worker held at 1.0, matching pre-pandemic norms and down sharply from the 2022 peak of 2 to 1, while the quits rate declined and layoffs reached their highest level since October, suggesting less confidence among workers and heightened caution from employers.

Although nonfarm payrolls grew by 139,000 in May—above expectations—revisions to the previous two months subtracted 95,000 jobs, and private-sector hiring decelerated to its slowest pace in two years. The unemployment rate remained steady at 4.2% as labor force participation dropped to a three-month low of 62.4%, with the decline concentrated among both prime-age and foreign-born workers amid sharply reduced immigration and stepped-up deportations under President Trump’s policies.

Wage pressures persisted, with average hourly earnings rising 0.4% month-over-month and 3.9% year-over-year, as a tighter labor market supported pay gains even as job creation slowed. The ADP data showed business services, education, and health care shedding jobs, while sectors such as leisure, hospitality, and financial activities continued to expand. Manufacturing payrolls dropped by 8,000—the biggest decline this year—reflecting exposure to tariff-related cost pressures, and the federal government cut 22,000 jobs, the largest monthly decrease since 2020. The participation rate drop to a three-month low of 62.4%, coupled with fewer immigrants joining the labor force, is expected to lower the breakeven rate for monthly job growth needed to keep unemployment stable, with projections suggesting it could fall as low as 90,000 or even zero by year-end if deportations accelerate.

US worker productivity declined at a 1.5% annualized rate in Q1, marking the first contraction since mid-2022 and a sharper drop than previously estimated, pushing unit labor costs up at a 6.6% rate for the quarter. Corporate profits have come under pressure, and uncertainty from tariffs has led several major companies to withhold 2025 guidance. The combination of slowing job growth, declining labor participation, elevated wage gains, and rising unit labor costs has complicated the Federal Reserve’s policy calculus, as stable unemployment could delay rate cuts even as economic activity and productivity soften.

· The US trade deficit narrowed sharply in April, shrinking by a record 55.5% to $61.6 billion as imports dropped 16.3%—the largest monthly plunge on record—while exports rose 3%. This dramatic reversal reflects the end of widespread front-loading by companies ahead of higher tariffs, with new US reciprocal duties on imported goods taking effect at the start of the month. Imports of consumer goods, notably pharmaceuticals, as well as industrial supplies, vehicles, and capital equipment, all fell significantly. The US trade deficit with Ireland and China narrowed notably, with China’s goods trade gap dropping to $19.7 billion and imports hitting their lowest level since the early pandemic. The April trade numbers set up net exports to make a significant positive contribution to Q2 GDP after weighing on growth in the first quarter, though any benefit could be limited as inventories of previously imported goods are drawn down.

At the same time, the Federal Reserve’s Beige Book survey highlights a slight decline in overall US economic activity in recent weeks, with tariff uncertainty and elevated policy unpredictability cited as major drags on both business and household decisions. Price growth was described as moderate, but many contacts expect costs to accelerate further, especially as companies plan to pass along tariff-related increases to consumers within three months. Business commentary reveals widespread hesitancy in hiring and capital expenditures, with most regions reporting flat employment and modest wage gains, alongside weaker labor demand. The outlook captured by the Fed remains “slightly pessimistic and uncertain,” reflecting broad-based caution among firms facing tariffs, cost increases, and slower demand.

Anecdotal evidence from regional Fed districts underscores the pervasive impact of tariffs and uncertainty, with businesses raising prices, paring back investments, and in some cases reducing operations or workweeks. Some industries, such as manufacturing and retail, noted layoffs and constrained profit margins, while others observed shifts in consumer behavior and reduced discretionary spending. Policy uncertainty, immigration changes, and reductions in government funding further complicate the business landscape.

Eurozone

· Euro-area inflation in May eased to 1.9% year-over-year, falling below the European Central Bank’s 2% target for the first time in eight months and coming in beneath consensus expectations. Core inflation moderated to 2.3%, with a pronounced cooling in the services sector. The recent disinflation primarily reflects a reversal of temporary cost pressures from April, though persistent factors such as lingering US tariffs point to continued price moderation ahead.

The region’s economic momentum surprised to the upside in the first quarter of 2025, as GDP expanded by 0.6% quarter-over-quarter—twice the pace of the previous estimate. The outsized growth was driven by surging exports, particularly from Ireland and Germany, as firms rushed orders ahead of anticipated US tariffs, with exports alone contributing 0.9 percentage point to GDP. Investment also provided a significant boost.

However, more recent PMI data indicate that while the eurozone economy continues to expand, the pace of growth is slowing. The HCOB Eurozone Composite PMI Output Index slipped to 50.2 in May from 50.4 in April, the weakest expansion since February. Manufacturing was the principal driver, rising to 49.4 from 49.0, as services activity contracted for the first time since November, slipping to 49.7 from 50.1, and demand remained generally weak, with exports continuing their protracted decline.

Among the largest eurozone economies, Italy showed the strongest private sector output (Composite PMI 52.5, a 13-month high), while Spain (51.4), France (49.3), and Germany (48.5) all reported softer or contracting activity. New business intakes declined for an eleventh consecutive month, and firms continued to reduce order backlogs. Employment growth was marginal, with service-sector hiring offset by further manufacturing job cuts. Despite these challenges, business sentiment improved to its highest level since early 2022, supported by expectations of further ECB rate cuts and the rollout of fiscal stimulus in Germany.

· The European Central Bank (ECB) reduced its deposit rate by 25 basis points to 2.0%, marking its eighth rate cut in the past year and bringing borrowing costs to what the central bank considers a neutral level. ECB President Christine Lagarde signaled clearly that the bank is nearing the end of its aggressive easing cycle, stating that rates are now at a "good position." Market expectations suggest a pause at the July meeting, with possibly just one additional rate cut toward year-end, depending on future economic data.

The ECB’s decision reflects ongoing concerns about the eurozone’s subdued economic growth and persistently muted inflation outlook. The central bank revised downward since March its inflation forecast to 2.0% in 2025 (previously 2.3%), 1.6% in 2026 (previously 1.9%), before rebounding to the target of 2.0% in 2027. Economic growth projections were also slightly adjusted lower to 0.9% for 2025 (unchanged from previous forecast), 1.1% in 2026 (previously 1.2%), and steady at 1.3% in 2027.

These downward revisions reflect the eurozone's vulnerability to international trade tensions, particularly from ongoing disputes with the U.S. administration, which threaten exports and business investment. Falling energy prices and a stronger euro are expected to exert additional downward pressure on inflation. However, rising incomes, a robust labor market, and improving financing conditions are expected to partially offset these negative factors.

While the ECB meeting saw strong consensus around the recent rate cut, Reuters’ sources indicated policymakers expressed a clear majority preference for maintaining stable rates at the July meeting. Several officials even suggested a longer pause, emphasizing that little additional data will become available in the short term. Policy deliberations indicated future decisions would be data-dependent, with particular emphasis on new economic forecasts due in September. Lagarde also highlighted potential support for the eurozone economy from increased government investments in defense and infrastructure, along with improved investor confidence reflected in stronger foreign capital inflows.

UK

· UK economic activity showed signs of modest stabilization in May, with the S&P Global UK Composite PMI rising to 50.3 from 48.5 in April, moving just above the neutral threshold but still at the second-lowest level since October 2023.

Growth was driven by a rebound in the services sector, where output increased and confidence improved, reflecting receding concerns over US tariffs and more resilient consumer sentiment. The S&P Global UK Services PMI rose to 50.9 in May from a 27-month low, buoyed by improving optimism, new marketing initiatives, and competitive pricing, although growth in activity was only marginal and well below the long-term average. Manufacturing, by contrast, remained mired in contraction, with the S&P Global UK Manufacturing PMI rising to 46.4, still deep in negative territory for an eighth straight month. Output and new orders continued to decline, affected by weak global demand, persistent trade uncertainties, rising cost pressures, and tariff-related disruption.

On the fiscal front, the UK’s policy environment is a growing source of concern for economic prospects. The OECD warned that Chancellor Reeves’s strict adherence to fiscal rules leaves the UK with a “very thin fiscal buffer,” exposing the economy to significant downside risk in the face of adverse shocks. With only £9.9 billion of headroom under current rules and new public spending allocations imminent, any increase in borrowing costs or downgrade in growth forecasts could force additional tax hikes or spending cuts. The OECD cut its UK GDP growth projections to 1.3% for 2025 and 1% for 2026, citing heightened trade tensions, tighter financial conditions, and elevated policy uncertainty. High payroll taxes and the national living wage continue to drive services inflation and keep borrowing costs elevated, compounding the challenge. The OECD expects the Bank of England to reduce rates gradually to 3.5% by mid-2026 and maintain its quantitative tightening program, but warns that fiscal and monetary policy constraints, together with weak confidence and soft demand, are likely to limit the pace of economic recovery. Despite these challenges, the UK is still projected to be the second fastest-growing G7 economy in 2025-26, though that growth remains vulnerable to both domestic and external risks.

Asia

· Japan’s economic growth momentum moderated in May, with the au Jibun Bank Japan Composite PMI edging down to 50.2 from 51.2 in April, signaling only a marginal expansion in private sector activity. The service sector continued to grow but at a slower pace, with the Services PMI dropping from 52.4 to 51.0, its weakest in six months, while manufacturing output saw a sustained decline, as the Manufacturing PMI rose from 48.7 to 49.4 but remained in contraction for the eleventh consecutive month.

Service providers reported softer gains in business activity and new orders, while export growth slowed to a five-month low. Employment in services increased for the twentieth straight month, though the pace of hiring was the slowest since December 2023. Firms continued to face sharp input cost inflation—driven by higher energy, labor, and transport expenses—leading to a solid rise in output prices. Despite these pressures, input price inflation across the private sector eased to a 14-month low, and selling price inflation moderated to its slowest in nearly four years.

Manufacturers faced only a modest fall in new orders, with export demand remaining subdued due to US tariffs and client hesitancy. Production cuts persisted but were less pronounced than earlier in the year, and job creation in manufacturing accelerated to its fastest since April 2024 as firms anticipated an eventual pickup in global demand and introduced new products. However, companies continued to reduce inventories and purchasing activity in response to soft demand and some supply chain disruptions.

· China’s economic momentum weakened in May, as the Caixin China General Composite PMI fell below the 50.0 threshold to 49.6, marking the first contraction in overall activity since December 2022. This downturn was primarily driven by a sharp decline in manufacturing, where the PMI dropped to 48.3—the lowest reading since September 2022—reflecting a marked deterioration in both output and new orders, especially for investment goods. Manufacturing export demand continued to contract for a second consecutive month, and overall factory employment declined at a faster pace, with backlogs of work falling as firms coped with weaker demand and rising competitive pressures.

In contrast, the service sector demonstrated modest resilience, with the Caixin China General Services PMI rising to 51.1, extending its expansion streak to 29 months. Growth in new business accelerated, underpinned by business development efforts, though export orders in services fell for the first time this year, reflecting the impact of ongoing global trade frictions. Services employment rebounded after two months of contraction, marking the fastest pace of hiring since last November. However, cost inflation in services accelerated to the quickest since last October, driven by rising purchase prices and wages, while providers cut output prices for a fourth consecutive month amid heightened competition and promotional activity.

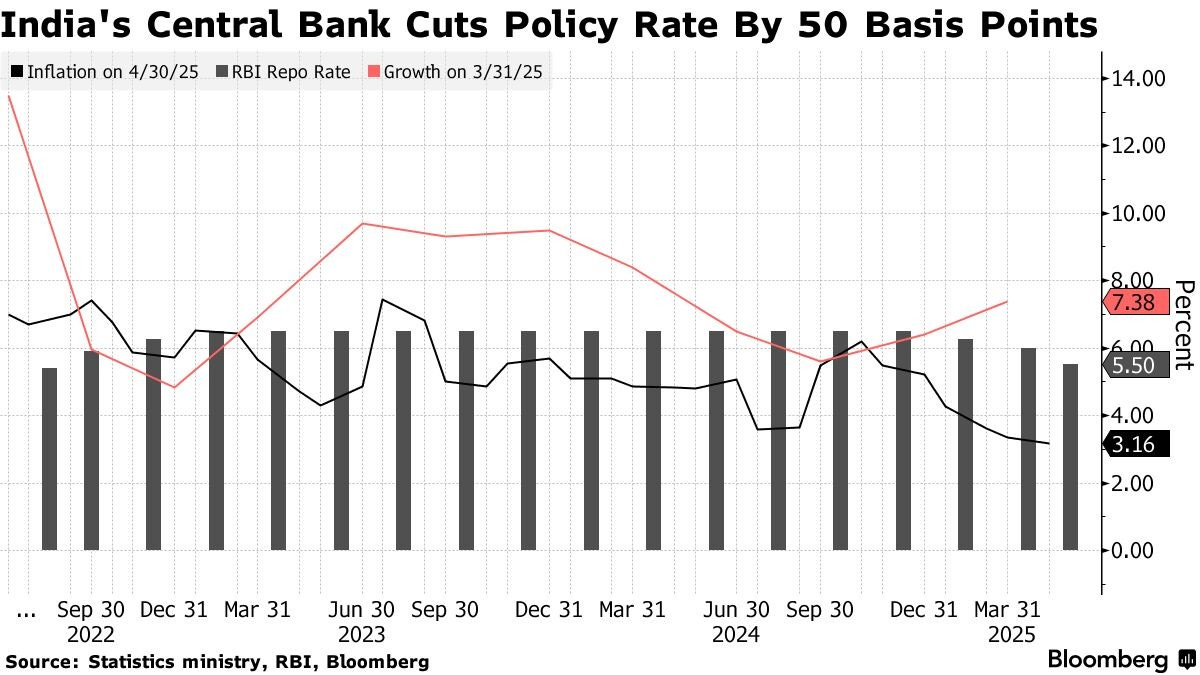

· India’s central bank delivered a larger-than-expected policy easing, cutting the benchmark repurchase rate by 50 basis points to 5.5% and reducing the cash reserve ratio for banks by 100 basis points to 3%, which will inject approximately 2.5 trillion rupees ($29.1 billion) of liquidity into the financial system. The moves come as economic growth decelerated to 6.5% for the fiscal year ended March, below the government’s 8% growth target, and as inflation has consistently undershot the RBI’s 4% target for three consecutive months, prompting a downward revision of the inflation forecast to 3.7%.

The RBI’s monetary policy stance shifted to neutral from accommodative, suggesting that further easing will be limited barring a significant deterioration in growth or inflation. The central bank emphasized that any additional policy action will depend on incoming data and evolving economic risks, including global headwinds such as new US tariffs. Indian assets initially reacted with volatility, but equity markets finished higher, and shorter-dated yields dropped in response to the liquidity boost, while the rupee stabilized

The central bank’s actions are designed to stimulate business and consumer sentiment and catalyze credit growth, which recently slipped below 10% for the first time in over three years. Authorities anticipate that the rate and liquidity cuts will help sustain growth momentum, encourage private investment, and provide support to rural and urban demand, especially with supportive external factors like low oil prices and an early monsoon. The RBI, however, signaled that the room for further easing is now constrained and that future moves will hinge on whether economic growth falls short of its current 6.5% forecast or inflation deviates from its favorable trajectory.

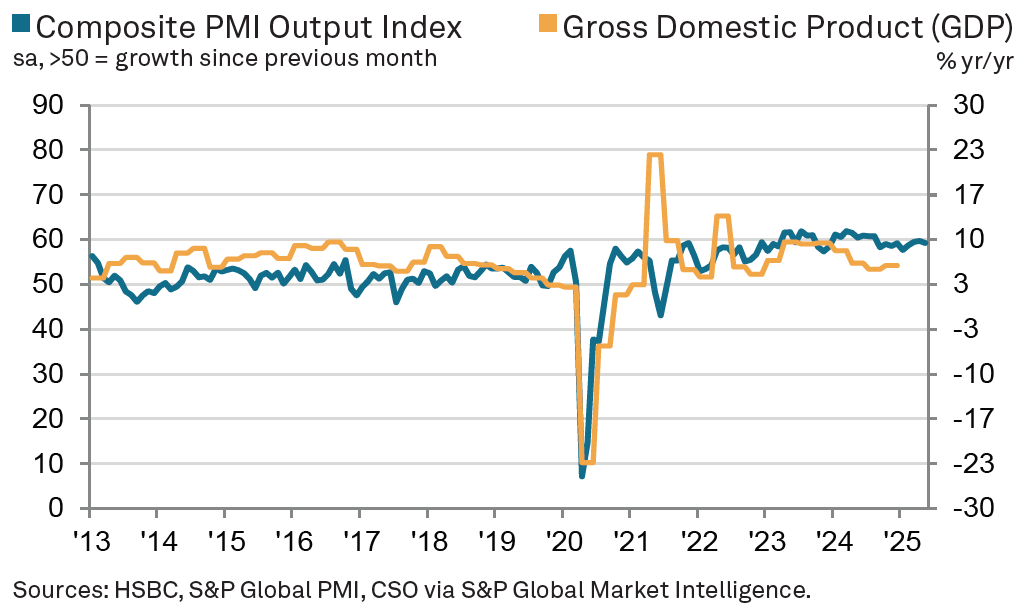

· Meanwhile, India’s private sector continued to deliver robust growth in May, as the HSBC India Composite PMI registered 59.3, only marginally down from April’s 59.7, signaling sustained sharp expansion. While the pace of manufacturing growth eased slightly to a three-month low, it remained strong by historical standards, with the Manufacturing PMI at 57.6, far above the long-run average. Service sector activity accelerated, with its PMI holding steady at 58.8, reflecting resilient domestic and international demand. Export performance stood out as a key driver, with both manufacturers and service providers reporting some of the strongest increases in foreign orders in years.

Demand for Indian goods and services continued to fuel substantial job creation, with aggregate employment rising at a record pace across both sectors. In manufacturing, permanent hires featured more prominently, while service providers recorded their highest-ever employment index reading, responding to swelling order books. Business sentiment recovered from recent lows, with confidence among both manufacturers and service firms supported by expectations for ongoing demand strength, expanded customer bases, and continued investment in capacity and marketing.

Foreign Exchange Markets

The U.S. Dollar Index, which measures the dollar against a basket of major currencies, edged down by 0.1% over the past week.

Commodities and Energy Markets

The commodities sector ended the week broadly higher, with gains across most major asset classes.

Debt and Fixed Income Markets

Market Movements

According to CME data, the implied Fed Funds rate curve over the next 18 months (ending in November 2026) moved higher by an average of 10 basis points, with the terminal rate now projected to be 17 basis points higher.

The probability of a June rate cut edged slightly higher to 2.6%, up from 2.2% the previous week. Looking ahead, markets continue to price in two rate cuts in 2025—in September and December—unchanged from a week ago. In total, 39 basis points of easing are priced in for 2025, down from 48 basis points.

Consistent with this outlook, the U.S. Treasury curve shifted upward by an average of 7 basis points. According to Bloomberg, the 10-year Treasury yield rose by 11 basis points to 4.51%, while the 30-year yield increased by 4 basis points to 4.97%.

Central Bank Insights

· Over the past week, Federal Reserve policymakers broadly agreed on maintaining a patient, data-dependent stance, awaiting clarity on tariff implications before making further adjustments.

Governor Christopher Waller indicated he sees a potential path toward rate cuts later this year, contingent upon tariffs settling near a 15% trade-weighted average, inflation continuing progress toward the 2% target, and a solid labor market. Waller expects tariffs will temporarily raise inflation and modestly increase unemployment, though he anticipates these effects will fade over time. He also highlighted fiscal deficit concerns, noting that persistently large deficits near $2 trillion annually (around 6% of GDP) have driven long-term Treasury yields higher.

Similarly, Chicago Fed President Austan Goolsbee suggested the economy remains fundamentally strong but emphasized a cautious stance until trade-related uncertainties resolve. He noted that if tariff uncertainty clears, allowing inflation and employment trends to stabilize, the Fed would have scope to proceed with interest-rate cuts.

Atlanta Fed President Raphael Bostic adopted a particularly cautious tone, suggesting he is in no hurry to adjust rates, though he acknowledged the potential for one 25 basis point cut in 2025. He emphasized the need to carefully monitor how tariff-driven price pressures evolve, cautioning that persistent tariffs could raise inflation expectations and require a policy response.

Governor Lisa Cook stressed the primacy of price stability, recognizing that tariffs could boost inflation and slow employment growth. Cook indicated particular vigilance over rising short-term inflation expectations, warning of the risk that elevated inflation could become embedded through second-round effects and lower productivity growth.

Minneapolis Fed President Neel Kashkari also advocated a wait-and-see approach, underscoring that the economy remains resilient but faces downside risks from prolonged tariff uncertainty, which could dampen business investment and labor market conditions.

Governor Adriana Kugler placed a strong emphasis on inflation risks from tariffs, stating most Fed policymakers currently prioritize inflation concerns over growth slowdown risks. Kugler expects tariff impacts on prices to be relatively quick, warning that persistent inflation pressures could emerge if tariffs remain elevated. She highlighted three channels—rising short-term inflation expectations, opportunistic business price-setting behavior, and declining productivity—that could sustain inflation.

Philadelphia Fed President Patrick Harker called for patience, stressing that monetary policy should remain steady amid significant uncertainties around tariffs. Harker noted potential rate cuts in the second half of the year are possible if clarity emerges, inflation continues moderating, and employment remains stable.

Dallas Fed President Lorie Logan stated the Fed is well-positioned to remain patient given balanced risks around inflation and employment. Logan reiterated caution regarding potential impacts of tariff-driven inflation on long-term inflation expectations.

Kansas City Fed President Jeff Schmid expressed concerns that tariffs might rekindle inflation pressures, advising the Fed to remain cautious and nimble. He stressed that the full effects of tariffs on inflation and employment would likely not be fully understood immediately, advocating for a steady, watchful stance.

You can find more articles in our Telegram channel at https://t.me/atranicapital_eng