Week #24 — Market Update for June 9-13, 2025

Executive Summary

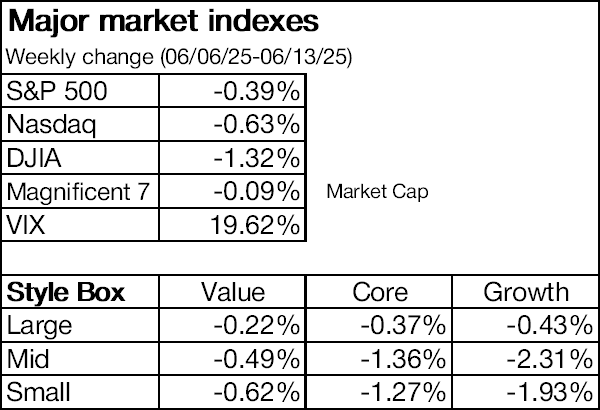

The U.S. stock market slid after two weeks of gains, with major indices declining between 0.4% and 1.2%, as optimism from recent progress in U.S.-China trade talks was overshadowed by escalating geopolitical risks in the Middle East.

Washington and Beijing agreed to a temporary framework allowing resumed Chinese shipments of rare earth metals—essential for defense and technology—in exchange for eased U.S. export controls, excluding advanced semiconductor technologies crucial to China’s AI ambitions. However, this framework remains primarily a negotiating structure rather than a comprehensive deal, calming markets but leaving significant issues unresolved.

Geopolitical tensions surged after Israeli airstrikes targeted Iran’s military and nuclear facilities, raising concerns about Tehran's potential retaliation, including disruptions to global oil supply through the critical Strait of Hormuz, responsible for roughly one-fifth of global oil trade. Bloomberg Economics estimates sustained oil prices near $100 per barrel could add 0.6 percentage points to U.S. inflation, increasing pressure on global central banks.

Crypto markets moved inversely to equities, with Bitcoin rising 1.7% week-over-week, driven by significant inflows of $1.4 billion into spot Bitcoin ETFs, fully reversing prior outflows.

Globally, country ETFs showed mixed performance: developed markets largely mirrored U.S. declines, while emerging markets rose modestly, leading the global ex-U.S. equity index slightly lower (-0.2%). Emerging markets could soon face increased volatility ahead of July’s expiration of Trump’s 90-day tariff pause with China. Investors anticipate turbulence, indicated by increased demand for bearish put options on emerging markets ETFs. Nevertheless, EM assets remain supported by a weaker dollar, attractive valuations, and inflows from investors diversifying away from U.S. equities.

Market expectations for a Fed rate cut in June nearly disappeared (now 0.4%, down from 2.6% last week), as muted inflation data provided the Fed little immediate incentive to change policy. Markets continue to price in two rate cuts later in 2025 (September and December), totaling 45 basis points—up slightly from last week’s 39 basis points.

Consistent with this outlook, the U.S. Treasury yield curve shifted downward by an average of 5 basis points. According to Bloomberg, the 10-year yield fell by 11 basis points to 4.40%, and the 30-year yield decreased by 8 basis points to 4.89%.

For comprehensive insights and deeper context, please refer to the full article.

US Stock Market

The U.S. stock market slid after two consecutive weeks of gains, with major indices decreasing between 0.4% and 1.2%, as optimism stemming from recent progress in U.S.-China trade discussions was overshadowed by rising geopolitical risks due to a rekindled conflict in the Middle East.

Washington and Beijing agreed on a framework permitting renewed Chinese shipments of rare earth metals, essential for defense and technology industries, in exchange for eased U.S. export controls—excluding advanced semiconductor technologies critical to China's AI ambitions. However, this “trade framework” remains primarily a temporary agreement and negotiating structure rather than a comprehensive deal, aiming mainly to calm markets and project progress while leaving significant agenda items unresolved.

Geopolitical tensions surged this week following Israeli airstrikes targeting Iran’s military and nuclear facilities, amid heightened concerns about potential further retaliation by Tehran, including disruptions to global oil flows through the strategically crucial Strait of Hormuz, which accounts for roughly one-fifth of global oil trade. Bloomberg Economics estimated that sustained oil prices near $100 per barrel could elevate U.S. inflation by an additional 0.6 percentage points, further pressuring global central banks.

In terms of sector performance, six out of eleven sectors showed negative momentum, with the Energy sector surging on rising crude oil prices.

The Fear & Greed Index, which gauges market sentiment, decreased to 60 from 63 a week ago.

The SPY ETF has started to exhibit mild consolidation after testing the psychological resistance near 600, consistent with expectations given recent momentum. The RSI has moderated from 65.04 to 58.90, reflecting a slight easing in bullish momentum but remaining firmly within a constructive bullish range. Price action remains robustly supported above key technical areas, particularly the confluence of the 100-day and 200-day SMAs near 580, underlining the strength of the prevailing uptrend.

Cryptocurrency Market

The crypto market once again moved opposite to stock markets, with Bitcoin rising by 1.7% Friday-over-Friday amid mixed movements among major tokens. This was supported by significant weekly inflows of $1.4 billion into spot Bitcoin ETFs, fully reversing the previous two weeks of outflows.

Global Markets

Globally, country ETFs showed mixed movements, with developed markets moving in sync with the U.S. market, while emerging markets rose modestly, resulting in the global ex-U.S. equity index slightly decreasing by 0.2%. However, emerging markets could soon face increased volatility due to the potential renewal of U.S.-China tariff tensions after Trump’s 90-day pause ends in early July. Investors are preparing for turbulence, as reflected by increased demand for bearish put options on the iShares MSCI Emerging Markets ETF, suggesting expectations for near-term declines. Despite these concerns, EM assets remain supported by the weaker dollar, attractive relative valuations, and inflows driven by investors diversifying away from U.S. assets.

The ACWX ETF has begun a modest consolidation after testing the upper boundary of its ascending channel, aligning with expectations of a potential short-term pullback. The RSI has moderated notably from 69.40 to 61.31, signaling a healthy reduction in bullish momentum, yet still firmly positioned within a bullish zone. Crucially, the ETF remains strongly supported by its upward-sloping key SMAs—the 50-day, 100-day, and 200-day—which underline the ongoing bullish technical structure.

Economic Indicators, Statistics and News

Several important macroeconomic indicators and economic news were published during the week:

Global

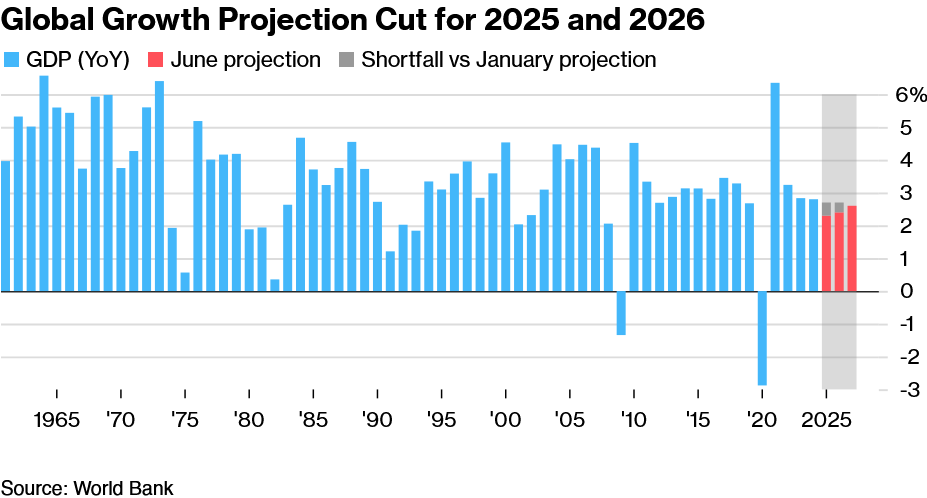

· The World Bank significantly reduced its global economic growth forecast for 2025 to 2.3% from a previous estimate of 2.7%, marking the weakest expansion in 17 years, outside of recessions triggered by the global financial crisis and the Covid-19 pandemic. According to its revised outlook, average global growth for the first seven years of this decade is expected to be just 2.5%, making the 2020s the slowest-growing decade since the 1960s.

This deterioration stems primarily from heightened international trade tensions and policy uncertainties, notably influenced by the renewed protectionist stance under President Donald Trump’s administration. Trump's intensified tariff policies—aimed not only at adversaries like China but also at traditional allies—have disrupted global supply chains, deterred investment, and undermined economic stability.

Specifically, the World Bank cut growth forecasts for approximately 70% of economies globally. The United States’ growth outlook was notably lowered by 0.9 percentage points to 1.4%, reflecting the direct impact of volatile trade policies. The euro area and Japan have also experienced downward revisions, each projected to expand by only 0.7%, a decrease of 0.3 and 0.5 percentage points respectively, while China’s forecast remained steady at 4.5%.

Emerging and developing economies face pronounced challenges, with slower growth anticipated for nearly 60% of these countries. Low-income nations, in particular, saw their growth forecast reduced by 0.4 percentage points to 5.3%.

The World Bank underscored that continued escalation of trade barriers or persistent uncertainty around international policy could exacerbate financial stress and further dampen growth prospects. Additionally, potential spillovers from weakening major economies, geopolitical conflicts, and climate-related disruptions pose significant risks.

Chief economist Indermit Gill emphasized that without corrective actions to ease trade tensions and adopt disciplined fiscal policies focused on employment, global economic conditions could deteriorate further, jeopardizing living standards worldwide. The World Bank suggests that resolving trade disputes and enhancing policy clarity are crucial steps toward stabilizing the global economic outlook.

· President Donald Trump secured a significant legal victory as the U.S. Court of Appeals for the Federal Circuit allowed his administration to temporarily maintain global tariffs, overturning a lower-court injunction and extending an earlier reprieve. This ruling preserves Trump's authority to enforce tariffs under the International Emergency Economic Powers Act (IEEPA), despite legal challenges from small businesses and a coalition of Democratic-led states. Opponents argue these tariffs are economically harmful, but the administration maintains they are essential for trade negotiation leverage and national security. The expedited case is scheduled for a full hearing on July 31, underscoring its broader implications.

Meanwhile, Trump reaffirmed his aggressive tariff stance, announcing plans to unilaterally establish new tariff rates through forthcoming letters to various trading partners. The July 9 deadline is critical, marking the date when Trump’s administration could significantly increase tariffs—potentially up to 50%—on countries that fail to finalize new agreements. Trump's administration has prioritized bilateral trade agreements with major economies, including Japan, India, South Korea, and the European Union.

Negotiations with the EU remain particularly complex, involving around €380 billion ($434 billion), or approximately 70% of European exports to the U.S. The EU proposed gradual tariff elimination for automobiles, industrial goods, and select agricultural products, but insists on retaining regulatory autonomy. Should talks falter, the EU is prepared to implement retaliatory tariffs on €21 billion worth of politically sensitive American products, alongside tariffs on another €95 billion targeting significant U.S. exports, including aircraft, automobiles, and bourbon. U.S. Commerce Secretary Howard Lutnick expressed cautious optimism, though he acknowledged Europe might be among the last deals finalized.

Japan, another major U.S. trade partner, continues negotiations under considerable pressure to avert substantial tariff increases—particularly on automobiles (up to 25%) and steel and aluminum (up to 50%)—which threaten its economic stability. Japanese negotiators expressed optimism that a bilateral agreement could grant Japan special exemptions from broader tariff hikes. Talks remain ongoing, with a key meeting anticipated between Prime Minister Shigeru Ishiba and Trump at the upcoming G7 summit in Canada, underscoring geopolitical considerations tied to Japan's substantial holdings of U.S. Treasury bonds.

U.S.-China negotiations resulted in a fragile truce following intensive, 20-hour discussions in London. Both nations agreed on a framework permitting renewed Chinese shipments of rare earth metals, essential for defense and technology industries, in exchange for eased U.S. export controls, excluding advanced semiconductor technologies critical to China's AI ambitions. President Trump claimed the broader trade framework was finalized, with China agreeing to provide rare earths upfront and tariffs remaining at reduced yet significant levels totaling approximately 55%. However, persistent unresolved issues, such as China’s trade surplus and U.S. allegations of market dumping, continue to pose risks to future stability.

Trade discussions between India and the U.S. have hardened, complicating progress toward an interim deal. The U.S. demands that India open its markets to genetically modified crops, remove price controls on medical devices, and relax data localization regulations. India, in turn, seeks exemptions from U.S. tariffs on steel, automobiles, and pharmaceuticals, threatening reciprocal tariffs if no agreement is reached by the July 9 deadline. Despite tensions, analysts anticipate a phased agreement may eventually be reached, although it might extend beyond Trump’s preferred timeframe.

US

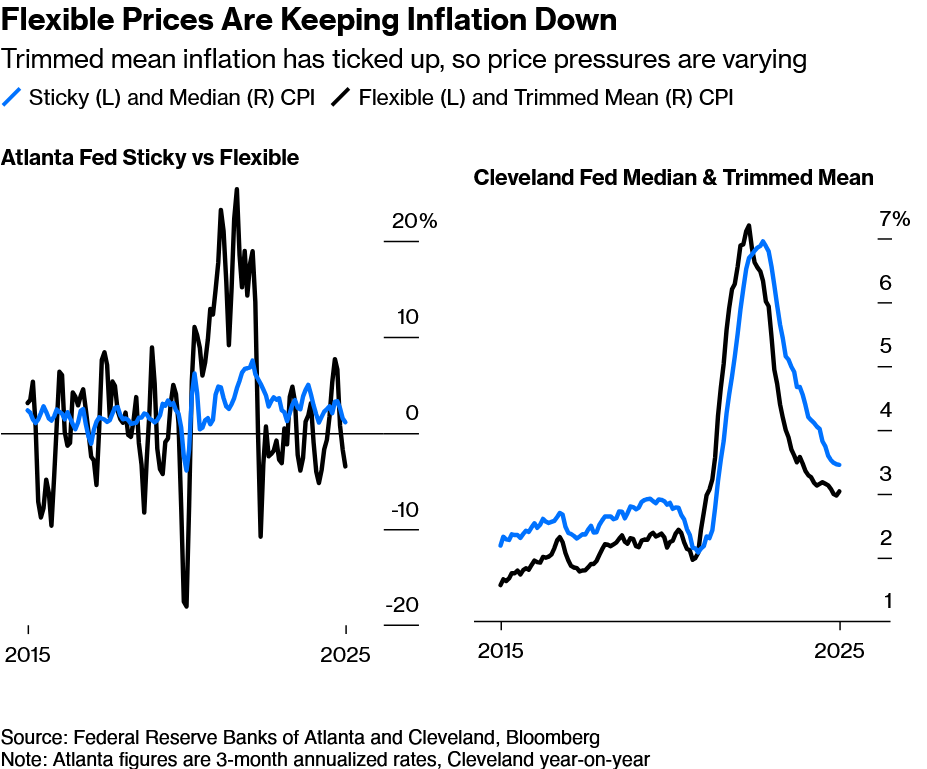

· Recent U.S. economic data indicate inflation pressures remain moderate despite President Trump's expanded tariffs, providing the Federal Reserve with little immediate cause for altering its monetary policy stance. In May, core consumer price index (CPI), which excludes volatile food and energy items, rose just 0.1% month-over-month, below economists' expectations of 0.3%, with an annual increase of 2.8% versus a 2.9% forecast. Overall CPI matched projections at 2.4% annually. These modest figures imply firms have largely absorbed tariff-induced costs instead of transferring them to consumers immediately, a trend supported by inventory accumulation and uncertainty around future trade policy.

Nonetheless, underlying inflationary pressures persist beneath the surface. The Cleveland Fed's trimmed-mean inflation measure, excluding outliers, rose above 3% again, highlighting ongoing core inflation risks. Furthermore, the Fed’s closely watched "supercore" inflation (services excluding shelter) ticked upward, reflecting persistent underlying price dynamics.

Producer prices (PPI) also showed subdued inflationary pressures, increasing just 0.1% month-over-month and 2.6% year-over-year, compared to expectations of a 0.2% monthly rise. Core PPI slowed slightly to 3.0% from April's 3.2%. Although consumer durable goods and capital equipment prices showed slight tariff-related increases, the overall data suggest minimal price impact thus far.

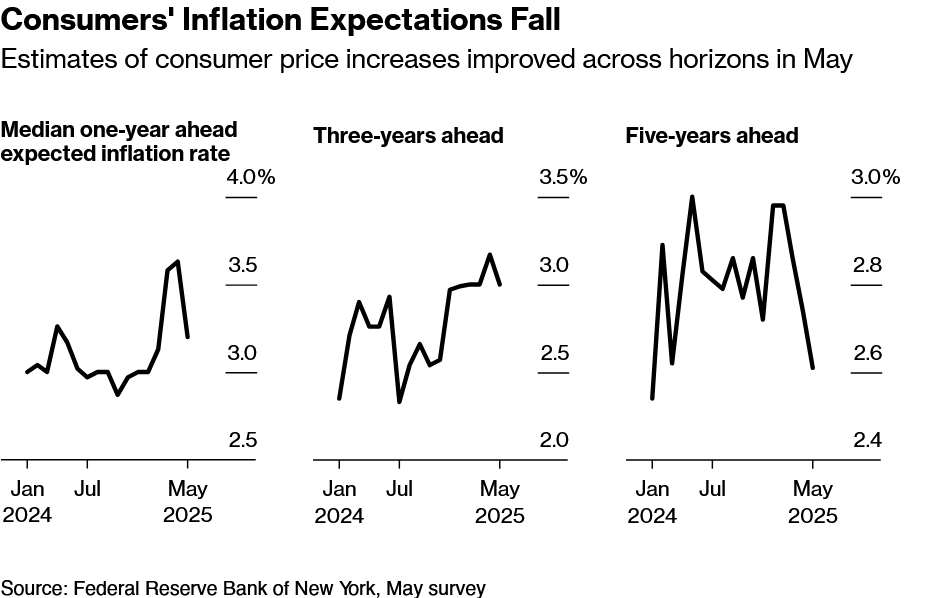

Despite these inflation dynamics, consumer expectations for future price growth notably improved. The New York Fed survey indicated expectations for inflation one year ahead declined significantly to 3.2% from 3.6% in April, while three- and five-year inflation expectations also moderated slightly.

Similarly, the University of Michigan’s consumer sentiment survey for June showed the most significant monthly improvement since January 2024, with one-year inflation expectations sharply declining from 6.6% to 5.1%. This sentiment boost came amid reduced concerns about extreme tariffs following the temporary trade agreement between the U.S. and China.

Small businesses reflected improving sentiment as well, with the National Federation of Independent Business (NFIB) optimism index increasing for the first time in 2025 to 98.8, driven by stronger expectations for business conditions and sales. However, heightened uncertainty surrounding trade policy and pending tax legislation remains prominent. While a considerable 31% of small businesses anticipate raising prices soon—highlighting latent inflationary pressures—hiring plans and compensation increases softened, reflecting more cautious labor market dynamics.

Eurozone

· The Bank of France downgraded its economic growth and inflation forecasts through 2027, highlighting the negative impact of ongoing US trade tensions and tariffs on Europe’s second-largest economy. It now expects French GDP growth of 0.6% in 2025, down from a previous forecast of 0.7%, with further reductions to 1.0% in 2026 (previously 1.2%) and 1.2% in 2027, reflecting cumulative losses of about 0.4% due to US trade policy uncertainties.

Inflation projections have also been revised downward, reflecting weaker economic conditions, reduced raw material prices, and a stronger euro. Inflation in France is now expected to reach only 1.8% by 2027, below the European Central Bank's (ECB) 2% target.

UK

· The UK economy experienced its most significant monthly contraction in 18 months in April, shrinking 0.3%, driven by sharp tax hikes, rising US tariffs, and declining exports. This downturn followed two consecutive months of expansion, undermining the Labour government's strategy of funding increased public spending through accelerated economic growth. April’s contraction was worse than anticipated by economists, who had predicted a decline of only 0.1%.

Services, the UK’s largest economic sector, shrank 0.4%, particularly affected by the housing market slowdown triggered by higher stamp-duty taxes effective April 1. Manufacturing output also declined by 0.9%, primarily reflecting a substantial drop in exports to the US, which fell by £2 billion—the largest monthly decline since records began in 1997—due to the imposition of US tariffs. Construction provided a slight offset, registering modest growth.

Economists survey by Bloomberg and the Bank of England now forecast significantly subdued growth, averaging just 0.3% quarterly until the end of 2026. Consequently, financial markets are now fully pricing in two further quarter-point interest-rate cuts by the Bank of England this year in response to economic fragility.

UK retail activity further illustrates the pressures on consumers, with May retail sales posting a modest 1% annual gain, the weakest increase since November. Non-food sales notably declined by 1.1%, reflecting constrained consumer confidence amid rising inflation, elevated grocery prices, and increasing utility bills. Barclays reported consumer spending growth slowing sharply to 1% from 4.5% the prior month, highlighting ongoing caution among UK households.

While some analysts regard the current slowdown as partly temporary, influenced by adjustments following tax and tariff shifts, uncertainty remains substantial. Continued economic sluggishness heightens risks of further tax hikes later this year, potentially exacerbating already weakened consumer and business confidence.

Asia

· Japan's economy faces mounting pressures amid intensifying US trade tensions, as confirmed by recent economic data and surveys. GDP contracted by an annualized rate of 0.2% in the first quarter of this year, revised from an initial estimate of a 0.7% drop. Although the revision indicated somewhat improved inventories and marginally positive private consumption (0.1% growth), these factors also highlight underlying weaknesses, such as unsold goods, signaling sluggish demand.

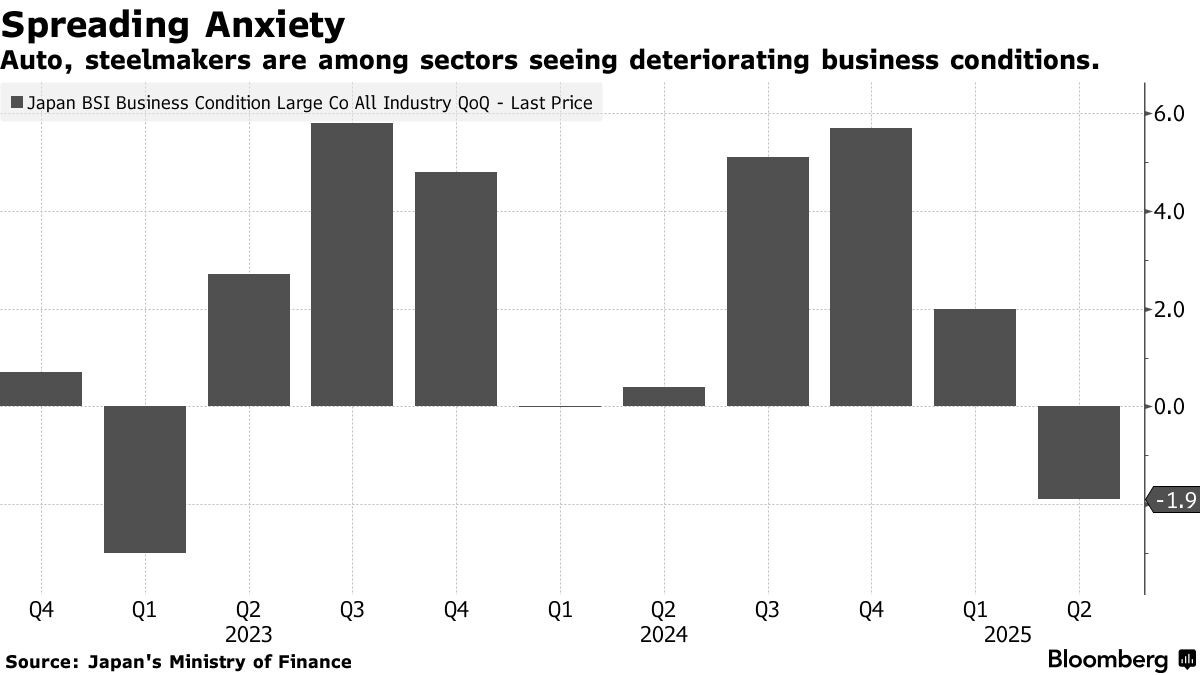

The core reason for the economic contraction stems from weak exports, heavily impacted by sweeping US tariffs implemented by President Donald Trump. Japan's exports consequently fell notably in May, exacerbating manufacturers' difficulties. Reflecting this, business sentiment among large firms dropped into negative territory (-1.9) for the first time in over a year, driven by sharp declines in critical manufacturing sectors—automakers sentiment plunged dramatically to -16.1 and steelmakers fell sharply to -29.1.

· China's economy faces intensifying challenges, as ongoing deflationary pressures and weakening exports to the US underscore deepening structural weaknesses. Consumer prices declined by 0.1% year-on-year in May, marking the fourth consecutive month of deflation, driven primarily by weak domestic demand and intense price competition among businesses. Concurrently, factory prices fell by 3.3%, representing a prolonged 32-month deflationary trend. These conditions reflect persistent oversupply in key industrial sectors, notably in chemicals and raw materials such as coal, which are also suffering from lower global prices.

Although China’s two national holidays in May temporarily boosted service-related consumption, the overall impact was insufficient to reverse broader deflationary forces. Analysts anticipate a continued deflationary environment, as highlighted by a Bloomberg survey projecting near-zero consumer inflation (0.3%) through 2025—the lowest forecast since polling began. The International Monetary Fund similarly forecasts zero inflation for China in 2025, the weakest performance since the 2009 financial crisis.

China's trade performance also exhibits signs of vulnerability, particularly regarding its largest market, the United States. Exports increased nearly 5% year-on-year to $316 billion in May, missing economists' expectations for 6% growth. This modest gain masks significant weakness in US-bound shipments, which plunged by 34.4%, marking the sharpest decline since February 2020. While China benefited from strong export demand elsewhere, especially from Vietnam (up 22%), driven by companies redirecting shipments to circumvent tariffs, the scale of the decline in the US market overshadowed these gains.

Cumulatively, China's trade surplus remains high, approaching half a trillion dollars between January and May, but declining imports—down 3.4% in May—indicate persistent domestic weakness. The trade environment's instability prompted Beijing to seek relief via negotiations, resulting in a temporary tariff truce with the US. However, the outlook remains uncertain as front-loading of exports may fade, leading to potential deceleration later this year. Economists project growth slowing to around 4% in the final quarter of the year, reflecting vulnerability to global trade disruptions and persistent internal demand weakness.

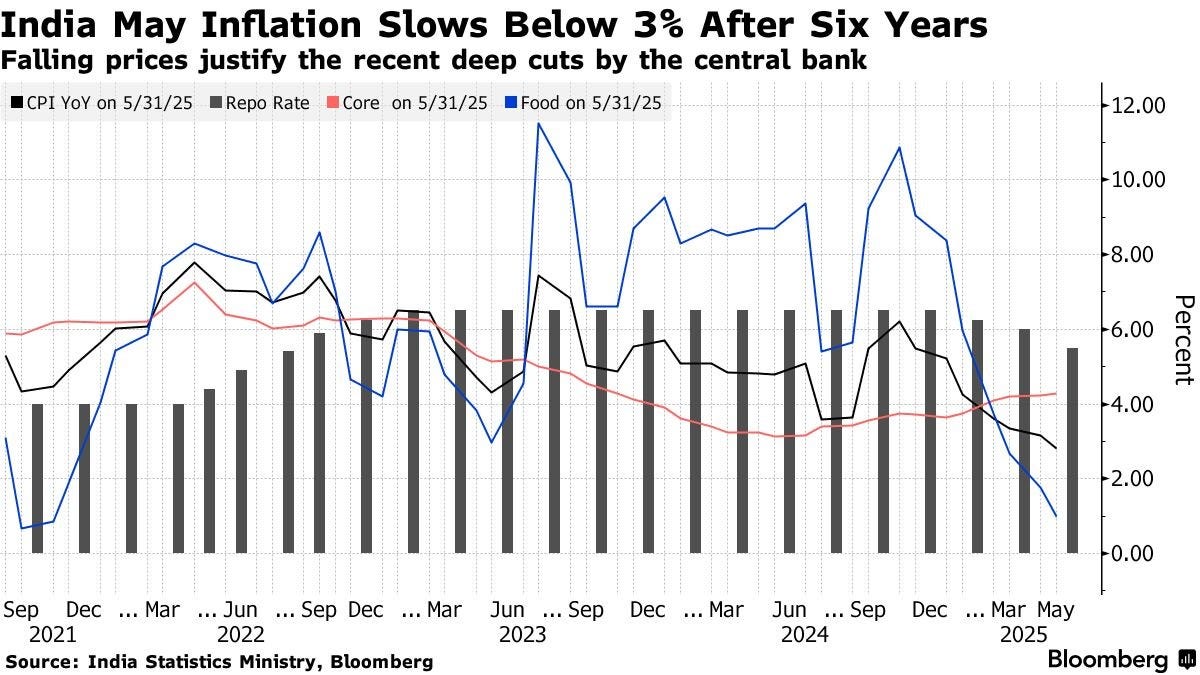

· India's inflation rate continued its downward trajectory in May, marking the seventh straight month of decline. Consumer prices rose just 2.82% year-over-year—the slowest rate since February 2019 and notably below market expectations of 2.98%. This follows April's inflation rate of 3.16%. The sustained easing validates the Reserve Bank of India's (RBI) recent decision to aggressively cut interest rates by 50 basis points and lower its fiscal-year inflation forecast to 3.7% from the previous 4%.

The primary driver behind the inflation moderation is food prices, which rose by only 0.99% compared to April's 1.78% increase. Vegetable prices fell significantly by 13.70%, following a 10.98% decline in April. The early onset of India's monsoon season is expected to further support agricultural output and keep food inflation subdued in coming months, given that food comprises nearly half the consumer price index.

Core inflation, which excludes volatile food and energy components, slightly edged up to 4.28% from 4.23% in the previous month. Despite the modest uptick, core inflation remains relatively stable, reinforcing the central bank's current neutral policy stance.

While the recent easing has created monetary policy space, analysts anticipate the RBI is likely to adopt a cautious approach moving forward, suggesting a "prolonged pause" on additional rate cuts. Future inflation risks depend significantly on monsoon developments, which could impact agricultural output and food price trends.

Foreign Exchange Markets

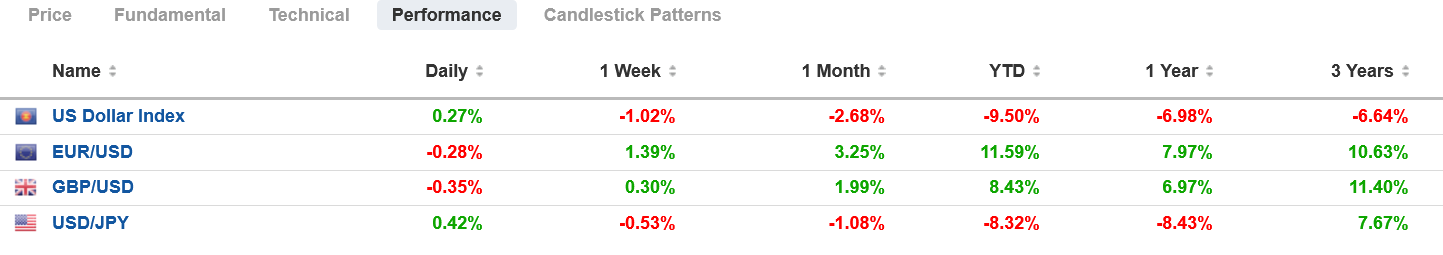

The U.S. Dollar Index, which measures the dollar against a basket of major currencies, decreased by 1.0% over the past week, touching its lowest level in three years amid escalating concerns about the economic impact of U.S. tariffs and expectations of substantial monetary easing by the Federal Reserve. The euro advanced to its highest since 2021, while the British pound hit a three-year peak; overall, all G-10 currencies appreciated against the greenback.

Year-to-date, the dollar has weakened by almost 10%, as market participants increasingly anticipate Trump's tariffs and fiscal policies will negatively impact the U.S. economy. Speculators currently hold approximately $12.2 billion in bets anticipating further dollar depreciation. Influential investors such as Paul Tudor Jones have projected a potential 10% decline in the dollar over the coming year, driven by expectations for dramatic cuts in short-term U.S. interest rates.

Commodities and Energy Markets

The commodities sector ended the week broadly higher, with gains across most major asset classes.

Oil markets experienced significant volatility over the past week following a dramatic escalation of geopolitical tensions in the Middle East. Israel’s extensive airstrikes against Iranian targets triggered fears of a wider regional conflict, directly impacting crude oil prices. West Texas Intermediate (WTI) surged over 13%, while Brent crude jumped nearly 12%. The rapid price gains erased earlier losses for the year, previously driven by global trade uncertainties and increased OPEC+ production.

The airstrikes heightened concerns regarding potential disruptions to global oil flows, particularly through the strategically crucial Strait of Hormuz, responsible for roughly one-fifth of global oil trade. JPMorgan estimated potential supply disruptions exceeding 2.1 million barrels per day if the situation escalates. The conflict also pushed up shipping costs, with forward freight agreements for Middle East-to-Asia crude shipments climbing 15% to $12.83 per metric ton, reflecting significant market anxiety. Major tanker operators, including Frontline Ltd., have become notably hesitant to route ships through the Persian Gulf, introducing an additional risk premium into freight rates.

Despite immediate price spikes, Goldman Sachs analysts modestly raised their short-term oil price forecasts by only $2-$3 per barrel, retaining their expectation that prices would decline below $60 per barrel by the fourth quarter of this year. However, they cautioned that a worst-case scenario involving prolonged disruptions could propel prices above $100 per barrel, while a bearish scenario could see prices below $50 by next year.

Market participants have exhibited heightened hedging activity, with significant demand observed for call options priced above $85 per barrel, reflecting concerns over further upside risks. Nonetheless, broader market sentiment appears cautious rather than panicked, as traders and analysts generally perceive an extended blockage of the Strait of Hormuz as improbable due to the significant U.S. naval presence in the region. Furthermore, both OPEC+ and the International Energy Agency (IEA) hold substantial spare capacity and emergency reserves, respectively, offering potential stabilization mechanisms if disruptions occur.

Looking forward, traders remain wary of further escalations, notably potential Iranian retaliation targeting regional energy infrastructure or actions triggering stricter international sanctions on Iranian oil exports. However, some market participants view the current rally as a possible short-term selling opportunity, drawing from historical precedent where geopolitical risks have not resulted in sustained supply disruption.

Debt and Fixed Income Markets

Market Movements

According to CME data, the implied Fed Funds rate curve over the next 18 months (ending in November 2026) shifted downward by an average of 6 basis points, although the terminal rate is now projected to be 11 basis points higher.

The probability of a June rate cut has nearly vanished (just 0.4%, down from 2.6% the previous week), as muted inflation data provided the Federal Reserve with little immediate cause for altering its monetary policy stance, although it leaves room to act if the economy decelerates in the future. Looking ahead, markets continue to price in two rate cuts in 2025—in September and December—unchanged from a week ago. In total, 45 basis points of easing are priced in for 2025, up from 39 basis points.

Similarly, the U.S. Treasury curve shifted downward by an average of 5 basis points. According to Bloomberg, the 10-year Treasury yield fell by 11 basis points to 4.40%, while the 30-year yield decreased by 8 basis points to 4.89%.

Central Bank Insights

· Bank of Japan Governor Kazuo Ueda reiterated that while Japan’s current short-term policy rate of 0.5% remains the lowest among G7 countries despite Japan’s relatively high inflation rate, the BOJ’s next rate adjustment would likely be upwards rather than downwards. However, Ueda’s recent comments indicating that the central bank still sees itself as some distance away from sustainably achieving its 2% inflation goal led to further yen depreciation as markets perceived a delay in potential rate hikes.

At the upcoming policy meeting concluding June 17, market consensus strongly anticipates the BOJ to keep its benchmark interest rate steady at 0.5%, reflecting unanimous expectations among economists surveyed by Bloomberg. Attention has shifted toward the central bank’s quantitative tightening (QT) strategy—specifically, the pace at which it will continue reducing government bond purchases. Since August last year, the BOJ has been cutting bond purchases by approximately ¥400 billion ($2.8 billion) per quarter, currently targeting monthly bond purchases of about ¥2.9 trillion by early 2026.

However, growing volatility in Japan’s bond market, particularly among super-long maturities, has prompted widespread anticipation that the BOJ will slow this pace. About 65% of economists polled expect the BOJ to decelerate QT to ¥200-¥300 billion per quarter starting next fiscal year.

Former BOJ executive director Eiji Maeda notably expects a halving of the reduction pace to around ¥200 billion per quarter. Maeda also indicated a likely pause in bond purchase adjustments once the monthly total approaches ¥2 trillion in early 2027, signaling to markets that further immediate cuts are unlikely.

In terms of interest rate projections, analysts have increasingly pushed back their expectations for the next rate hike. Previously anticipated as early as July, consensus now places the next potential move in January, supported by roughly 34% of respondents, while about 30% suggest October as a plausible alternative. Notably, future rate hikes are seen as contingent upon clarity regarding US tariff measures and their subsequent impact on the Japanese economy. If trade tensions ease significantly, particularly in the automotive sector, rate hikes could occur sooner. Otherwise, the BOJ might remain cautious, potentially deferring rate adjustments into early 2027. Once initiated, rate hikes are projected to continue incrementally every six months toward an eventual terminal policy rate between 1.5% and 2%, exceeding current market consensus expectations of around 1%.

· Bank of England Governor Andrew Bailey emphasized that the BOE could abandon its gradual pace of interest-rate cuts if inflation threatens to significantly undershoot the 2% target, suggesting a shift toward more aggressive easing might be warranted should economic indicators deteriorate markedly. Nonetheless, Bailey remains cautious, signaling that current conditions do not yet necessitate a departure from the BOE’s measured approach.

Catherine Mann raised notable concerns regarding the impact of the BOE’s quantitative tightening (QT), currently proceeding at approximately £100 billion per year, highlighting the tension between ongoing balance-sheet reduction and the efficacy of interest rate cuts. Mann indicated that QT, particularly through long-dated bond sales, exerts upward pressure on yields—potentially offsetting the desired stimulative effects of reducing short-term policy rates, and therefore complicating monetary policy transmission. Mann cited internal research suggesting that the first annual £80 billion QT program could elevate 10-year gilt yields by around 20 basis points, underscoring that gradual rate reductions of 25 basis points per quarter might prove insufficient given market volatility and international yield spillovers from the US.

Megan Greene reaffirmed her cautious stance on inflation, anticipating a near-term acceleration due to temporary factors before resuming a downward trajectory toward the BOE's 2% target over the medium term. Although Greene supported the recent quarter-point cut to 4.25%, she highlighted persistent risks of second-round inflation effects potentially feeding through into wage dynamics, thus complicating the disinflation process. Greene also pointed out persistent consumer caution—evidenced by the rising savings rate above 11.5%—which may dampen future consumption even amid declining interest rates, posing further downside risks to growth expectations.

Policymaker Swati Dhingra highlighted further economic vulnerabilities from Brexit and trade tensions, indicating that downside risks to both growth and inflation justify continued monetary easing. Sarah Breeden reinforced these concerns, noting emerging economic slack despite difficulty in precise measurement, thereby supporting further policy easing.

You can find more articles in our Telegram channel at https://t.me/atranicapital_eng